As one of Asia’s visionaries in the takaful industry, we care for your needs and safeguard your future.

Everyone likes to imagine a perfect future – a happy family, a promising career, stable financial and healthy as a horse. Unfortunately, that’s not the case. Critical illness can sneak on you when least expect it. According to the Department of Statistics Malaysia, 16,235 victims which make up 15% of medically certified deaths in 2019 were due to heart disease, hence making this critical illness as the number one cause of death in Malaysia.

In a separate report released in January 2020, other critical illnesses also took the center stage.Malaysia has recorded growth in new cancer cases over a period of years from 2012 to 2016, 115,238 compared to 103,507 cases recorded in the corresponding period of 2007 to 2011. These numbers are really worrying. Getting afflicted with a critical illness does not only affect you physically and emotionally, but threatens your financial situation too.

Critical illness in Malaysia doest not necessarily mean serious illness only such as heart attack or cancer. It also can be caused by accidents such as major head trauma, coma, loss of sight or hearing and many more. With the rising costs of treatments, hospitalisation and medication in Malaysia, you wouldn’t want to be caught in that situation, which will leave your life in shambles.

Furthermore, with our current situation where COVID-19 hits, it’s no longer a pandemic, but an endemic where the impact is going to stay with us forever. Nobody is safe, even those who have vaccinated still have the potential to be caught with the deadly virus. Many COVID-19 survivors claimed that the virus affected their lungs terribly even long after they have recovered where they still suffer from breathing difficulty. Who knows that this might be the side effect of COVID-19 and will lead to something worse like a critical illness in the long run?

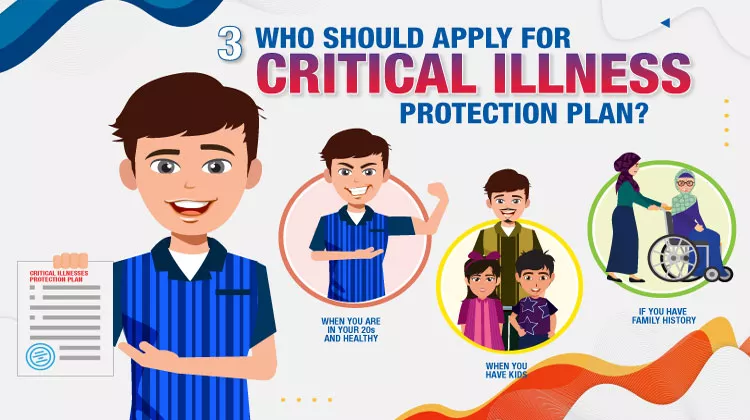

It’s true that we are in no position to go against God’s will. However, we must try really hard to be prepared for any outcome. What would you do if you were diagnosed with one of the critical illnesses? Where will the money come from? You could raid your savings, rack up your credit cards or borrow from someone. But would it be enough? This is where a critical illness protection plan can help, provided that you subscribe to the plan when you are healthy. Why? Because if you become ill, your options are more limited.

Let’s find out in depth what is critical illness protection and why do you need it:

Critical illness protection grants you a single lump sum payment, if you are diagnosed with any one of the covered critical illnesses in your plan. Unlike a health protection plan, critical illness protection is not designed solely to pay your hospitalisation or medical costs, but to provide a sum of money to take care of immediate expenses; which means you are free to use the money however you wish. For example you may utilise the benefit received to pay for your recurrent treatment costs or medical equipment, which are not covered under the medical protection plan if you have one. You may also use the money for home nursing care, seek alternative treatments or pay the mortgages for your family survival; whichever that can help you focus on your recovery.

How much is enough to protect myself against this unfortunate event?

The rule of thumb to ensure adequate critical illness protection in Malaysia is 3x of your annual salary. Why 3 times? In the event of critical illness diagnosis, it takes at least 3 years for you to adjust your lifestyle and recover.

Take a look on the following infographic for better picture of the formula:

Terms & conditions apply. Click here for more information.

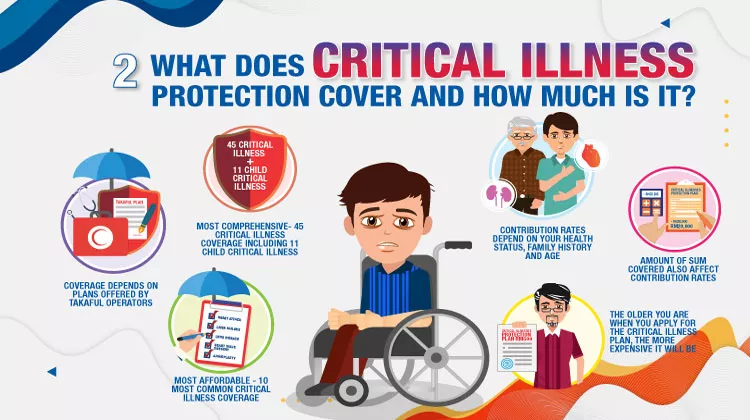

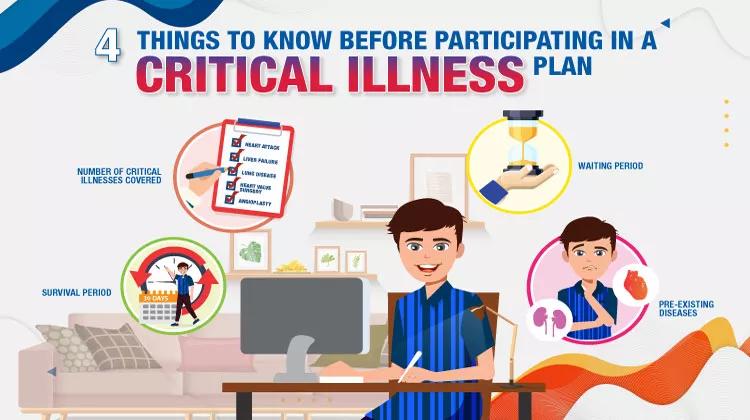

Critical illness protection coverage in Malaysia varies according to the plan you select. Different Takaful Operators offer varying levels of coverage, based on number, types and/or stages of critical illnesses covered whether early, intermediate or major. The most affordable critical illness protection plan in Malaysia would be the ones that provide coverage for ten most common critical illnesses, which are heart attack, cancer, kidney failure, stroke, coronary artery disease, liver failure, lung disease, heart valve surgery, coronary artery by-pass surgery and angioplasty and other invasive treatments. This plan is especially good if you are on a tight budget, as it only covers top 10 critical illnesses, which makes it much more affordable to commit to.

Whereas the most comprehensive critical illness protection plan covers 56 critical illnesses including 11 child critical illnesses which protect you and your family more extensively and offers a wider range of benefits such as blindness, coma, deafness, loss of speech, Parkinson’s disease, encephalitis, Mad Cow disease, poliomyelitis and many more. A comprehensive critical illness protection plan also includes coverage for child critical illnesses, which usually covers asthma, type 1 diabetes, Kawasaki, epilepsy, cholangitis and adolescent morbid obesity among others. Look for a comprehensive critical illness Takaful that provides coverage for both adults and children all in one plan. Although this would mean it costs slightly more, most of the critical illness protection plans are offered as a rider, where you can add to your basic Takaful plan at a later time whenever your budget permits.

As with all types of Takaful protection plans, critical illness protection contribution rates depend on the terms of the Certificate in addition to your health, family history and age. Oftentimes you are required to complete a health questionnaire concerning your current and past health history, as well as family history or undergo medical underwriting before your application is approved. Apart from that, the amount of Sum Covered will also affect the contribution rates. In general, the older you are when you apply for the critical illness protection plan, the more expensive it will be.

The main purpose of a critical illness protection plan is to compensate you and your family upon the diagnosis of a critical illness, irrespective of the cost of hospitalisation. Critical illness protection plan in Malaysia is nothing like the usual health protection plan. It is curated to help you pay for anything you choose, to assist you with your recovery and life adjustments when a life-threatening disease strikes you. It’s not easy to imagine being diagnosed with a critical illness, but it’s a reality for many of us Malaysians at some point in our lives. Critical illness protection plan is one way to reduce stress and the financial burden it will cause you and your loved ones and ensures you are better prepared to make ends meet.

If you have not yet subscribed to a critical illness protection plan and want to protect yourself and your loved ones, visit the various critical illness takaful plans we offer that suit you.

As one of Asia’s visionaries in the takaful industry, we care for your needs and safeguard your future.

Great Eastern Takaful is a name you can trust for all your takaful solutions.

Great Eastern Takaful’s visionary leaders have steered the company from strength to strength.