Key benefits

-

61 critical illness coverage for child and adult in one plan

Enjoy the widest critical illness coverage for child and adult under one single plan. Please see the list of 61 critical illnesses here.

-

Protection for 2 levels of severity

Protect yourself and loved ones against 2 levels of severity and receive payout of 25% for severity 25 and 50% for severity 50 respectively.

-

Multiple claims payout in the event of critical illness

Protect yourself, spouse and beloved children against critical illness and receive multiple claims payout in the event of any of the 61 critical illnesses, all under one plan.

Benefits at a glance

i-Lifetime Critical Illness Benefit Term Rider

i-Lifetime Critical Illness Benefit Term Rider

- Flexible coverage term of 25 or 80 years age next birthday

- 11 child specific critical illness and 50 adult critical illness coverage

- Continuous cover for Child Person Covered upon reaching 19 years age next birthday and above

i-Early Lifetime Critical Illness Benefit Term Rider

i-Early Lifetime Critical Illness Benefit Term Rider

- Flexible coverage term between 25 or 80 years age next birthday

- 50 critical illness coverage

- Allows for multiple claims of critical illness subject to severity level

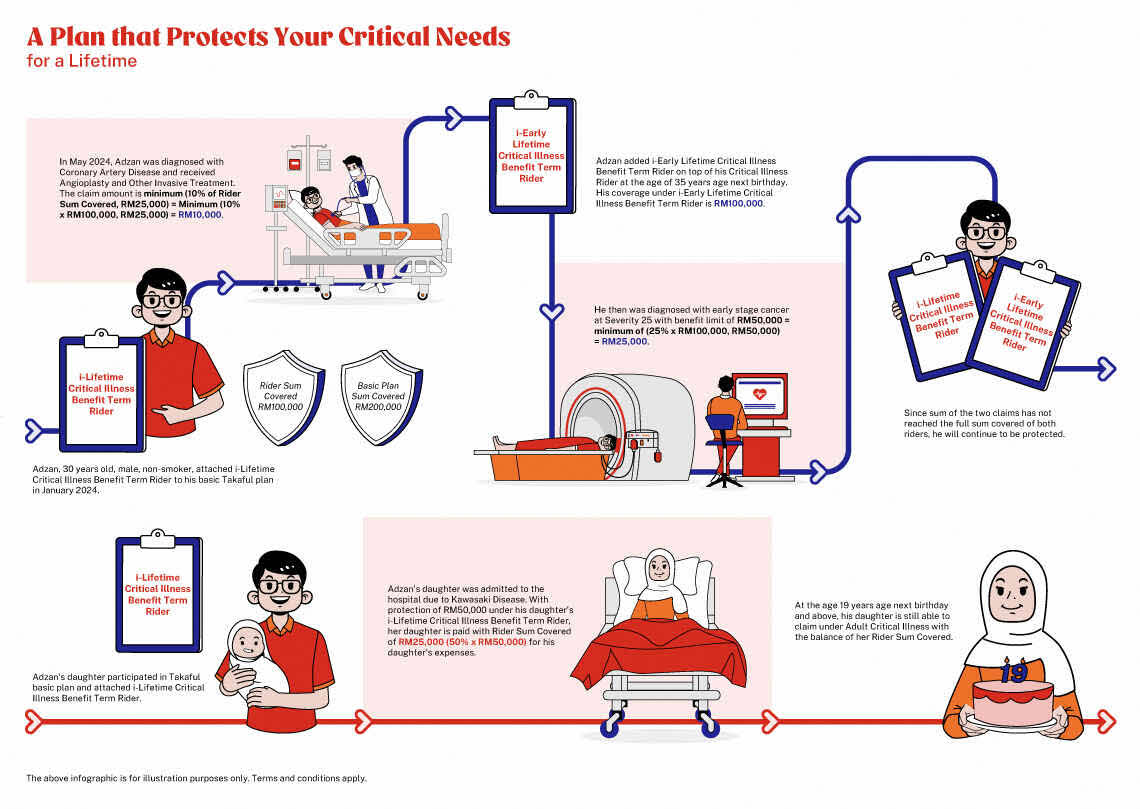

How i-Lifetime Critical Illness Benefit Term Rider & i-Early Lifetime Critical Illness Benefit Term Rider works

Your questions answered

These are contribution-paying riders. The contribution amount depends on your chosen Rider Sum Covered, age, gender, and smoking status.

A child must be at least 14 days old and no older than 15 years to qualify.

The minimum age requirement for adults is 16 years, while the maximum age is 70 years.

i-Early Lifetime Critical Illness Benefit Term Rider ensures that your current critical illness plan remains as it is, and is enhanced with early stage critical illness protection.

You may arrange to contribute by GIRO/Autodebit, DDA, Banker’s Order or credit card on an annual, half-yearly, quarterly, or monthly basis. Cheque and cash are allowed on yearly, half-yearly, and quarterly basis only.

Let us match you with a qualified Takaful advisor

Our Takaful advisor will answer any questions you may have about our products and planning.

How can we help you?

Understand the details before participating

- i-Lifetime Critical Illness Benefit Term Rider and i-Early Lifetime Critical Illness Benefit Term Rider are regular contribution paying Medical and Health Takaful riders attachable to selected regular contribution Term Family Takaful Plans that provides coverage in the event of Critical Illness.

- i-Early Lifetime Critical Illness Benefit Term Rider can be attached only if i-Lifetime Critical Illness Benefit Term Rider is attached. Claims on i-Early Lifetime Critical Illness Benefit Term Rider will deplete Sum Covered of i-Lifetime Critical Illness Benefit Term Rider which subsequently will deplete basic plan's Sum Covered as well.

- You should satisfy yourself that these riders will best serve your needs and that the contribution payable until the end of the certificate term is an amount you can afford.

- You may stop paying contributions and still enjoy protection as long as there are sufficient amount of money in the Participant’s Individual Account to pay for the Tabarru’, where applicable. However, there is a possibility of certificate lapsing when the required charges, including Tabarru’, exceed the money available in Participant’s Individual Account. Participating in too many riders or choosing high protection levels may deplete the cash values. Depending on the fund's performance, the Participant's Individual Account value may decrease and the certificate may potentially lapse.

- When riders are terminated or laid-off upon rider expiry date, no benefit will be paid from the Tabarru Fund.

- A “Free-Look Period” of 15 days from the delivery date of the certificate is given for you to review the suitability of these Medical and Health Takaful riders. If the certificate is returned to us during this period,

we shall refund an amount equal to the amount of contributions paid minus medical expenses (if any).

- If you switch your rider from one Takaful Operator to another or if you exchange your rider with basic plan, or vice versa, within the same Takaful Operator, you may be required to submit an application where the acceptance of your proposal will be subject to the terms and conditions to be imposed at the time of switching or replacement.

Terms and conditions apply. The info above merely provides general information only and is not a contract of family takaful. You are advised to refer to the benefit illustration, Product Disclosure Sheet and sample certificate for detailed features and benefits of the plan before participating in the plan. You may also refer to the consumer education booklet on Medical & Health Takaful issued under the Consumer Education Programme for more information.

Great Eastern Takaful Berhad is a member of PIDM. The benefit(s) payable under eligible certificate/product is (are) protected by PIDM up to limits. Please refer to PIDM’s TIPS Brochure or contact Great Eastern Takaful Berhad or PIDM (visit www.pidm.gov.my).