Key benefits

-

61 Critical illness coverage for child and adult

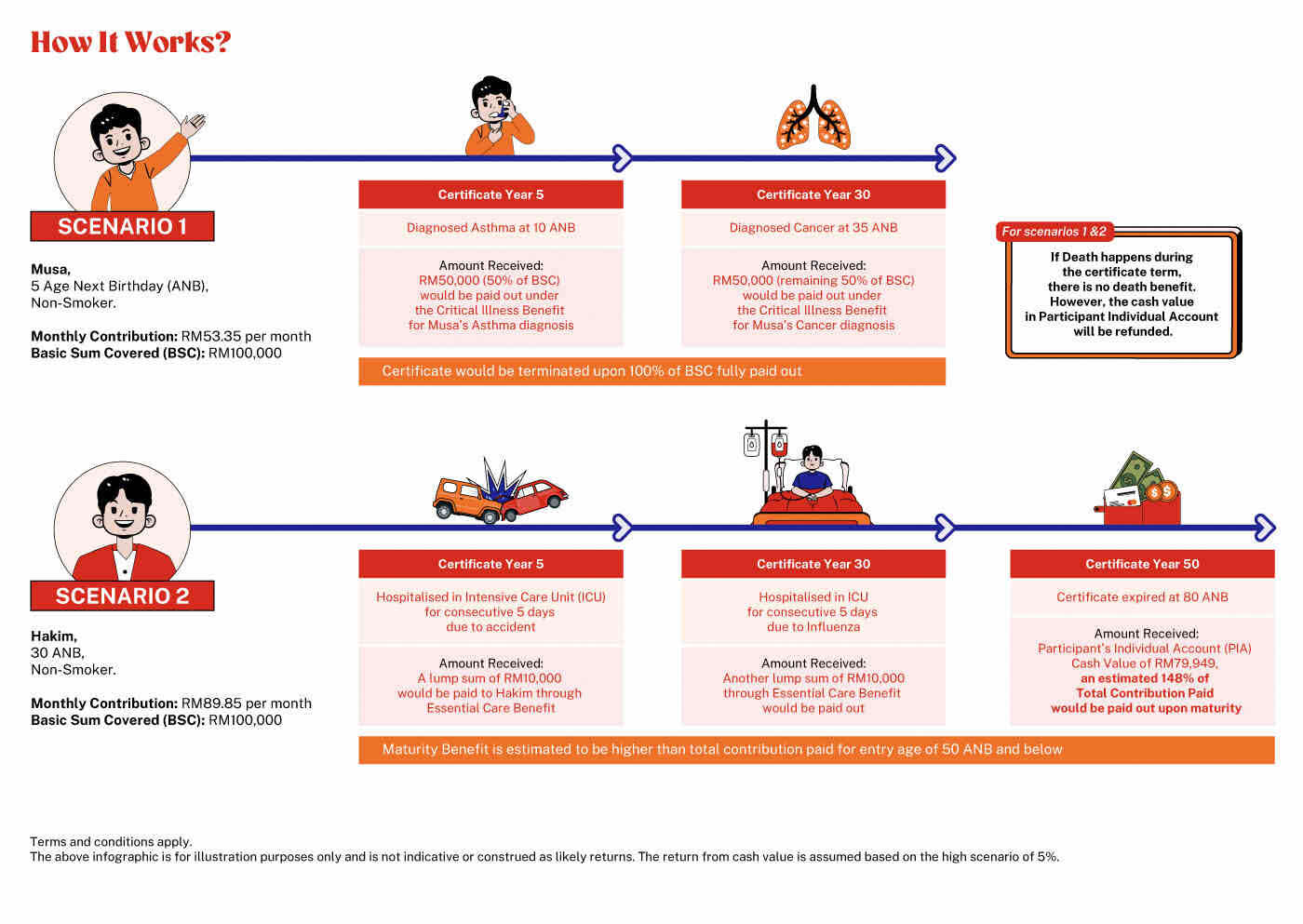

Upon the Person Covered diagnosed with any one of the Critical Illnesses ("Covered Event") except Angioplasty and Other Invasive Treatments for Coronary Artery Disease, the following will be payable.

● For Person Covered aged 19 years next birthday and above, 100% of Total Payout.

● For Child Person Covered aged 18 years next birthday and below, Total Payout capped at 50% of Basic Sum Covered will be payable. The balance shall be payable upon occurrence of any Covered Events when the Person Covered is 19 years next birthday and above. -

Essential care benefit (Supplementary hospitalisation care)

In the event of hospitalisation in the Intensive Care Unit (ICU) by the Person Covered for a minimum of 5 consecutive days, a lump sum of RM10,000 shall be payable from the Tabarru’ Fund.

-

Maturity benefit

Upon maturity, any amount left in Participant's Individual Account (PIA) will be payable.

How i-Great Yaqeen works

Your questions answered

i-Great Yaqeen provides protection against 61 critical illnesses for both children and adults.

The minimum age is 14 days old attained age and the maximum age is 60 years age next birthday

- 50 Critical Illnesses (1 year after the next birthday and onwards)

- 30-Day Waiting Period: Subject to 45 types of illnesses

- 60-Day Waiting Period: Subject to 5 types of illnesses

- 11 Critical Childhood Illnesses (1 – 18 years after the next birthday)

- 30-Day Waiting Period: Subject to 11 types of illnesses

i-Great Yaqeen does not cover any pre-existing conditions before or on the effective date or the date of reinstatement, whichever is later.

Let us match you with a qualified Takaful advisor

Our Takaful advisor will answer any questions you may have about our products and planning.

How can we help you?

Understand the details before participating

- i-Great Yaqeen is a regular contribution Term Takaful plan that offers Takaful protection and matures at age 80 years next birthday. It provides coverage upon the Person Covered being diagnosed with any one of the Critical Illnesses (“Covered Events”). This plan also provides an additional essential care benefit of RM10,000 (up to RM20,000) in the event of hospitalisation of the Person Covered in the ICU for a minimum of 5 consecutive days.

- You should be convinced that this plan will best serve your needs and that the contributions payable under the certificate are affordable to you. Contributions are payable until the end of your coverage term. If you do not pay within the grace period of 30 days, we will deduct the monthly Tabarru’ from the PIA. Your certificate will lapse and hold no value if the amount left in PIA is less than or equal to zero.

- Participating in a Takaful plan is a long-term financial commitment. The accumulated cash value that you may get when you cancel the certificate before maturity period will be much less than the total amount of contribution that you have paid.

- A “free-look period” of 15 days from the delivery date of the certificate is given for you to review the suitability of the plan. If the certificate is returned to us during this period, we shall refund an amount equal to the amount of contributions paid less any medical fee incurred, if any, for the medical examinations.

- Upon surrender, we will refund the cash value in PIA under this certificate (if any). Nevertheless, the unexpired Tabarru’ from the Tabarru’ Fund and the Unearned Unallocated Contribution from the Takaful Operator’s Fund (other than the first year Unallocated Contribution) less actual medical expenses incurred (if any) will be payable to you.

- Upon death of the Person Covered, certificate Maturity, or termination of certificate, any cash value from the PIA will be payable, which may be less than the total allocated contribution in the PIA. No benefit is payable from Tabarru' Fund.

- If you switch your certificate from one Takaful Operator to another or if you replace your current certificate with another certificate within the same Takaful Operator, you may be required to submit an application where the acceptance of your proposal will be subject to the terms and conditions to be imposed at the time of switching or replacement.

- The amount in PIA will be based on the actual performance of the fund and it is not guaranteed. Depending on the fund's performance, the PIA value may decrease and the certificate may potentially lapse. The investment risk under this plan will be borne solely by you and the PIA may be less than the total contributions contributed to the fund.

This brochure merely provides general information only and is not a contract of family takaful. You are advised to refer to the benefit illustration, Product Disclosure Sheet and sample of certificate for detailed features and benefits of the plan before participating in the plan.

i-Great Yaqeen is a Shariah-compliant product.

If there is a discrepancy between the English and Malay versions of this brochure, the English version shall prevail.

Great Eastern Takaful Berhad is a member of PIDM. The benefit(s) payable under eligible certificate/product is (are) protected by PIDM up to limits. Please refer to PIDM’s TIPS Brochure or contact Great Eastern Takaful Berhad or PIDM (visit www.pidm.gov.my).