For a man, there are two main events that he could not forget for the rest of his life; first is his puberty hits and two is his wedding day. It’s a mixed feelings of excitement, joy and fear.

Upon a marriage, we surely would dream of a perfect home, a happy family and a peaceful life. To achieve this, we need to prepare carefully. If we wish to build a house, we would first survey the designs, save some money and ask for opinions from other people before we begin the house construction. Same goes with building a strong marriage that lasts forever.

We have to prepare ourselves from all aspects. The man should learn to be the head of the family, know about basic carpentry, have a good financial management skill and basic car care. Whilst the woman should start learning how to cook and find out about their rights as a wife.

If there is enough preparation, God’s will the path towards a happy family will be easier to achieve. Sure there will be some challenges and ups and downs in the future, but we will be more prepared to face them.

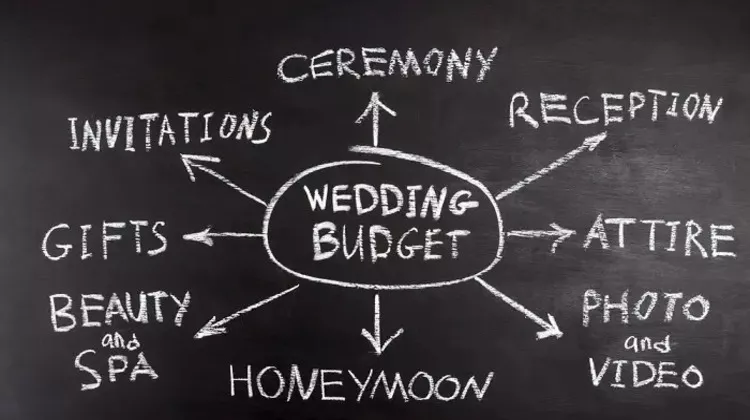

In this article, we will learn about financial preparation before stepping into the realm of marriage.

Try to estimate costs that you need to fork out from the asking for a hand in marriage ceremony until the day you become husband and wife.

For example, to ask for a hand in marriage would cost RM1,000, engagement ceremony RM3,000, wedding ceremony RM15,000 and moving into the new house would cost RM3,000. Therefore total cost would be RM22,000.

Once you get the estimation, then only you would know the amount that you need to save every month.

Discuss with your partner as early as possible on the amount of dowry she would like. It doesn’t matter how much, whether high or low, what’s more important is that both of you need to discuss about it. Some couples share their wedding costs, and for some, the groom will bear the whole costs.

Your partner should understand each other’s financial status. When both have reached mutual understanding, then only a realistic total expenditure can be set and within affordability.

A few couples are willing to take a personal loan just to get married, with RM20,00 to RM30,000 in debt, which has to be settled for years, even when the child enters Primary 1, the loan is still yet to be settled.

Most of them who took personal loan are due to pressure from surroundings, from relatives, to neighbours and friends, when in reality, they don't even know our financial status. What's more is, we are the ones who have to serve the loan, not them.

Saving should be done when you are single, as the commitment is still low, regardless whether you have a partner or not. Start saving as early as when you start your first job. By saving, you don’t have to be in debt to bear the wedding costs with your partner.

Take your time off to discuss with your partner on your direction in life and what are the goals both of you want to achieve. For example, questions like when to buy your first home, how many children would both of you want, retirement age, savings target, when to perform pilgrimage, etcetera.

You can open a joint account at any banks you prefer. The monies you wish to save together can be credited into this account. One of the benefits of having a joint account is when there’s an event of death.

In the event of your husband’s demise, his personal bank account will go to the estate of which it will need to through faraid process. However, for joint account, you as the owner of the account would obtain 50% of the total savings.

The income protection takaful is very important for husbands to participate, especially if you are the sole breadwinner with a full time housewife. If the husband passed away, the family would lose source of income, and it would be impossible for the wife to look for income in short period of time.

If you have takaful protection and eventhough the benefit might not be able to cover the family expenditure forever, it should at least be sufficient for the wife to breathe and plan for the next step to continue living without the husband on her side.

Many of us overlooked this topic. Topics on inheritance are mostly sad and full of arguments. To avoid these things from happening, do plan on your asset management as early as possible.

You should know your rights as an heir, who is eligible to be your heir and how much is faraid division. Do a will, keep receipts for easier matrimonial property claims and appoint an asset manager.

Do all these basic things and God’s will your financial status and your family will be in good hands.

Sources: