As parents, you would surely want to give only the best for your children – aspiring to see them infinitely happy and successful. To help them through future daily challenges adulthood may throw at them, parents would often prepare tools from moral education, knowledge to finances.

All these require careful planning from young, all the more so with the rising cost of living. The price of education is not cheap as it is not exempt from inflation.

The average cost for two semesters at a public university is about RM5,000. With the inflation rate of 4%, the cost would hit RM10,900 in 20 years which would equate to RM43,600 for an 8-semester course today.

On the other hand, 2 semesters at a private university are due to rise ranging from RM12,000 to RM26,300 in 20 years.

For example, if your child’s ambition is to be a doctor, the cost to support his or her education in the medical field for a year is RM60,000. In 20 years’ time, it will be around RM132,00.

Therefore, to avoid the burden of student debt, parents should begin to plan early. These days, a majority of youth are weighed down by student debt right after completing their studies. If you’re then able to prepare some funds in covering your children’s education costs, you would surely be able to lighten the load, enabling them to better ease into adulthood.

Perhaps one would think an education fund is unnecessary because of government incentives such as PTPTN loans. However, it’s not guaranteed that this incentive would be made available by then.

The earlier you start setting aside money for your child’s education fund, the lower the amount you would need to save monthly.

Let’s say you plan to have saved up RM50,000 for your child’s education fund by the time your child turns 20 years old. The table below shows a breakdown of savings you would need to set aside a month according to the year you begin saving. This calculation is based on the return rate of 5%.

| Age of Child | 1 year old | 5 years old | 10 years old | 15 years old |

|---|---|---|---|---|

| Monthly Savings | RM126 | RM193 | RM331 | RM754 |

You would only need to save RM126 a month if you start when your child is 1 years old, compared to RM331 if you were start saving if your child is aged 15.

For every time your child receives duit raya, save it in their savings account. You could also choose to save it in financial instruments that offer returns such as Tabung Haji or Amanah Saham Bumiputera (ASB).

The great thing about these savings is that they are versatile and would help your child in their adulthood. Even if it is not utilized for their education, the savings can be used for their wedding expenses or house/car deposit.

In addition to that, you also teach your children about the importance of savings and finances as they grow up.

Investment-linked takaful is a type of takaful plan that offers protection and long-term savings for the purpose of settling debt, retiring comfortably, as well as paying off education costs for adult children.

The upside of this plan is that it guarantees a continuation of education should parents not be around anymore. The sum covered received upon the parents’ death would be used to cover the cost of education for the children.

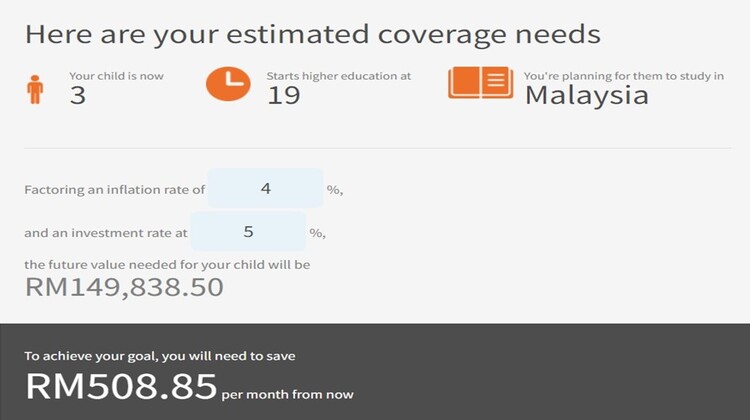

You may use this calculator to estimate the sum covered you may need and the monthly savings that need to be set aside for an education fund.

Example of calculation from education fund Takaful calculator

You may read more about investment-linked takaful plan offered by Great Eastern Takaful.

The convenience of tomorrow and beyond starts with today’s careful planning. It is just like planting a tree for your children and their children to enjoy its fruits.

Other than helping children with education funds, parents are also to cultivate in children the habit of saving and valuing money so that they would be able to manage their finances well in the future.