Do you know that a good personal financial management is related to psychology than mathematic. Most people will be turned off when they heard the topic of financial management. They think it will involve a lot of calculations.

However, managing financials do not depend solely on calculations, it is also the knowledge of how we interact with the money itself. How discipline are we when it comes to managing money.

Similar to tips for losing weight, you can read thousands of tips on it, but if you are not disciplined, the tips will become a waste.

There are only four basics of financial management that you can follow:

As stated above, financial management relates to psychology. You need to be more creative to ‘trick’ your mind and make the savings activity interesting and fun. These are some of the creative ways to save money.

1. Green fund

Every time you have RM5 banknote, keep it aside in a moneybox or piggy bank. Why RM5? Because the value of RM5 is not too big tor too small. Seldom have we received RM5 compared to other banknotes. And it will be too much to manage if we choose RM1.

Do this consistently for 6 months, then count the total. Take 10% as your reward for being disciplined in savings and keep the rest in the bank or other savings instruments.

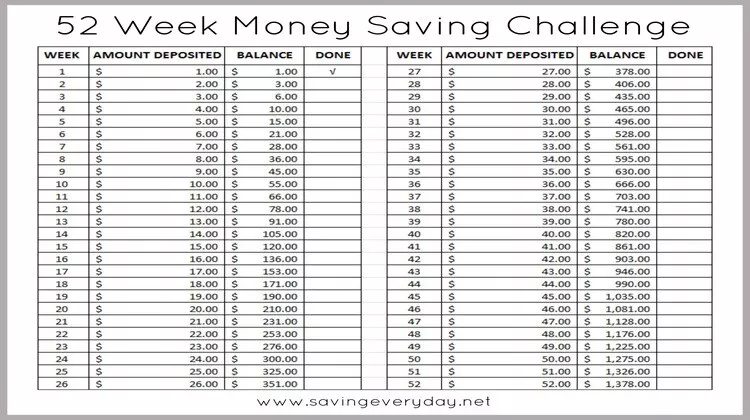

There are 12 months in a year, which is equivalent to 52 weeks. Prepare a moneybox and label it as “52 Week Fund”. Every week, save the money value equivalent to the week number. Save RM1 in Week 1, RM2 in Week 2 and so on until it reaches Week 52. This way, you can save RM1,378 a year and can use this to pay for your takaful protection.

Usually when we see that there are still balance in our bank account, we would not mind spending more. However, when we see that there’s only RM200-RM300 left, automatically we will be more frugal.

That is why we need to keep aside the savings portion as soon as we receive our salary and then only spend the balance. Keep aside at least 10% of salary or more if you can spare bigger amount.

This technique is suitable for them who are difficult to instil savings habit. With latest technology nowadays, the process of automating your savings becomes easier. Many banks provide this automated savings facility. Set a date with the savings amount every month. You don’t need to start with a big amount. Start with a small amount that we won’t notice if it’s gone. For example RM30 or RM50 a month.

So when can I spend my money? Once in a while, you want to splurge on yourself. If you want to buy a PS5 console that cost RM2,300, set a target to save twice the value of the PS5.

This means you need to save RM4,600. Putting PS5 as a reward will motivate you further to save. The more desire you have to buy the PS5, the more effort you will put to achieve the savings amount as soon as possible.

You can choose any method suitable with your character, the most important thing is that you achieve your savings goal. Maybe you have your own interesting savings tips that you are already doing it.

When your savings grow, then only you can invest in other instruments such as stock, unit trust or gold. Great Eastern Takaful also offer investment products that may be suitable for you.

Sources: