Debt when planned well can help you. But, it can also burden you due to overspending or buying something that is beyond your means.

Once a debt has started to stress you out, you need to work on resolving the debt problem. Aside from adding income, there are several techniques you can use to settle debt.

1. Avalanche technique

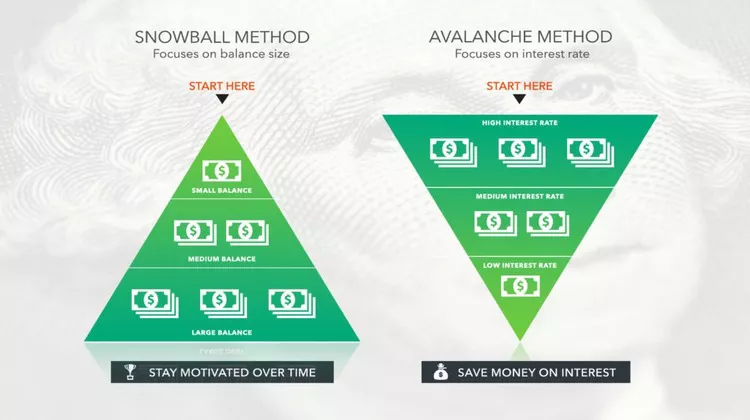

Avalanche technique is to settle debts that have high interest rates such as credit cards and personal debts first. Avalanche is the most efficient and economical technique as you can save more on paying interest. You can cut down on high interest payments.

How to do it?

First, list all your debts along with the amount and interest rate. Then, use your monthly excess cash to settle the debt with the highest interest rate first and at the same time, pay only the minimum for the other debts.

For example, let's say you have 3 debts as follows:

Settle credit card 1 debt first. For credit card 2 you only need to pay the minimum first and pay as usual for car debt. If credit card 1 has been successfully settled, focus on settling credit card 2 and finally the car debt.

Debt consolidation means you create one new debt to pay off all your existing debts. Small debts are consolidated under one new debt which usually offers a lower interest rate or monthly payment.

The advantage of this technique is that you don’t have to pay off debt in many places or channels. You can focus on one payment only.

Also, taking on new debt with a longer payment period will make the monthly payments lower. For example, previously you were supposed to pay RM1,000 a month for all your debts. After debt consolidation, you only have to pay RM600 a month. This technique is very beneficial for those who have cash flow problems.

In Malaysia, there are banks that offer specialized products for the purpose of debt consolidation.

This technique focuses on settling the smallest debt first until the largest. If we use the same example as above, credit card 2 needs to be settled first, then credit card 1 and finally the car debt.

This technique does not produce a profit in mathematical terms, but it is more to human psychology. Successful debt settlement will give you the motivation and momentum to settle your next debt. Therefore, you need to settle the debt with the lowest balance first regardless of what the interest rate is for each debt.

If you focus on settling large debts first, you see a slow reduction. It is easier to lose motivation. Unlike paying off a small debt first, in a short period of time, you can already see the change in the balance. You feel successful and motivated. Then you work on settling the second and subsequent debts until all your debts are successfully settled.

You can choose one of the techniques described above. Each has its own advantages and disadvantages. Choose the technique that is most comfortable and effective for your current situation.

Debt still needs to be settled even when we have passed away. Not only property is inherited, debt is also inherited. Plan your finances well so that we do not burden future heirs when something undesirable happens to you.

As for house debt, you may not have to worry because it is already taken along with takaful. Car debt is also included with takaful. But what about other debts? You can join additional takaful to cover these debts. Enter the amount of debt along with the calculation of death benefit of your takaful.