In this life, there are many important things that you need to protect. Act now to ensure your next generation is left with a meaningful legacy.

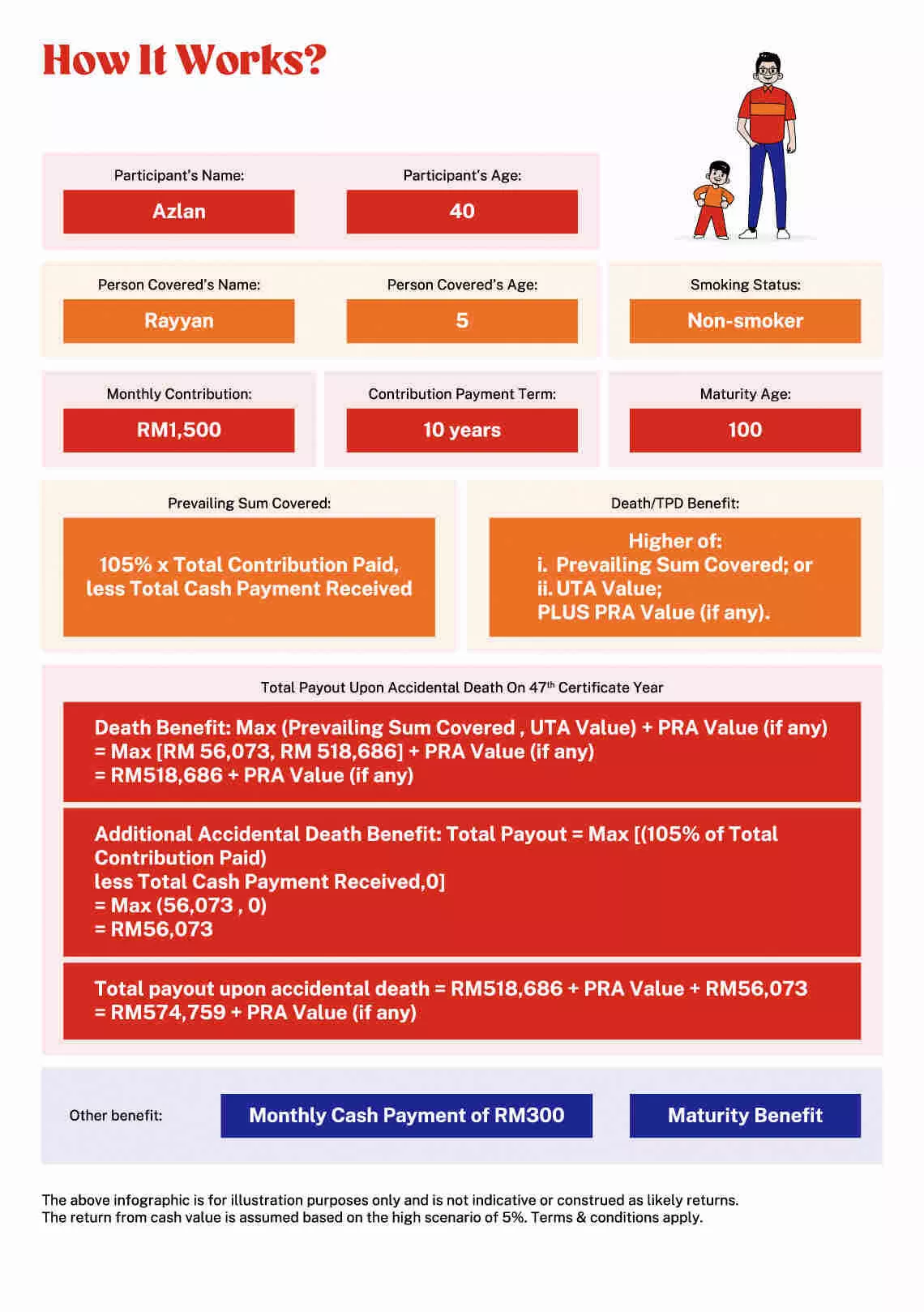

i-Great Infiniti is a takaful savings plan that ensures your family protected while enjoying continuous monthly cash payments until the age of 100 on your next birthday.

By starting your financial planning and legacy management early, it can give you peace of mind that you have provided financial protection and left a valuable legacy for your loved ones to settle your liabilities in the event of unforeseen circumstances. Expand your savings and increase your wealth with a plan specifically designed to help your family achieve the inspiration they dream of.

Participate in i-Great Infiniti takaful savings plan which also offers additional accidental death benefits and maturity benefits without medical underwriting. The promotion runs from From 4 December 2023 - 15 January 2024. Register today!

Note:

Terms and conditions apply

1Universal Takaful Account or UTA refers to the account which the contribution and any surplus and / or profit arising shall be allocated.

2 Participant’s Reinvestment Account or PRA refers to the account established for the reinvestment of the Cash Payment if Reinvestment option is selected.

3 Tabarru’ means a portion of Contribution allocated into the Tabarru’ Fund(s) as donation that You willingly relinquish in order to help and provide assistance to fellow Participants in need.

4 Sum At Risk means the excess of Prevailing Sum Covered over the UTA Value at the beginning of a certificate month plus any allocated contribution of the month, subject to a minimum of zero. Sum At Risk is payable from the Tabarru’ Fund 1.

5 Tabarru’ Fund(s) means pool of funds established for the purpose of solidarity and cooperation among the Participants in:

(a) Tabarru’ Fund 1 – for misfortune events (payment of claims);

(b) Tabarru’ Fund 2 – for events other than as specified in (a) above.