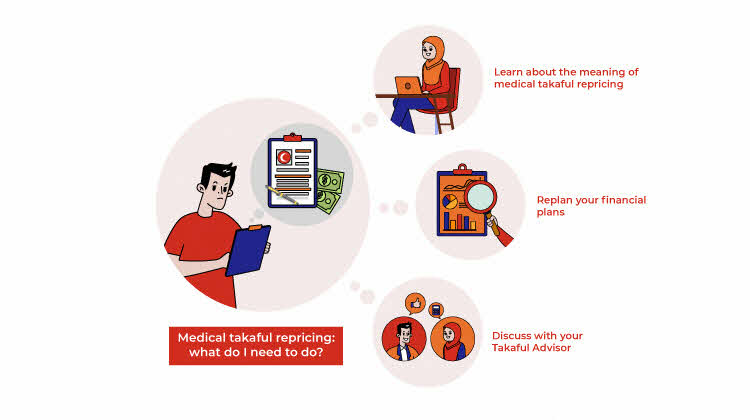

Medical Takaful Repricing: What Do I Need To Do?

Curious about what are medical takaful repricing and its impact on you? Learn what steps to take to adjust your financial plans here!

“Hold on, why is my medical card price different compared to my last contribution?” you whispered to yourself when checking your contribution bills. That is what we call a “medical repricing”.

Medical repricing is done to ensure that your health protection is always relevant and enough. Nonetheless, the concept of medical repricing can be quite tricky for some of us to grasp, especially to those who have never experienced such changes before. What exactly is medical takaful repricing? What are the steps that each of us need to take when this repricing occurs? Will the prices for takaful medical cards increase? We understand the concern since it is important for you to reevaluate your financial plans due to this repricing. In this article, we’ll explain how medical repricing affects you, and what you can do about it to keep a sufficient level of medical coverage.

Learn about the meaning of medical takaful repricing

The meaning of “medical repricing” is the changes in the medical takaful contribution. This change stems from the medical inflation itself. This phenomenon leads to the general increase in healthcare costs. Hence, takaful providers had to make necessary adjustments to cover the healthcare protection claims in the future. Remember when the price for a pack of nasi lemak used to be RM1 a few years ago, and the price doubled today? The same goes to our healthcare costs, the prices change over time.

The price changes for the takaful contributions may leave you confused. This is totally normal, especially for those who haven’t experienced this change yet. However, it is still important to be aware of the changes so that you can plan your financial plans accordingly. This understanding is also to help avoid any confusion or misunderstanding for this whole repricing concept.

Replan your financial plan

Due to the change in the medical takaful contribution, it is inevitable for you to replan your financial plans. This can help you achieve a more stable financial future, avoiding you from overspending. Reevaluate your finances so that you may improve in any way possible. If it is necessary, try scraping your whole plan and start from square one. This can give you a good start and overview on which financial plans need adjusting and improvement.

You can start by evaluating the level of importance in your financial plans. For example, decreasing your money allocated for hobbies and interests can help cover the increment of the takaful contribution price. By gradually replanning your finances, you can ensure the level of readiness to face any future challenges ahead.

Discuss with your takaful advisor

Still not sure what to do? Don’t worry, you can still discuss with your financial advisor or takaful advisor (agent). You can ask your financial advisor on more specific steps that need to be taken. You can also address any confusion or worry about the medical takaful repricing.

Your financial advisor or takaful advisor is ready to help give advice in managing and organising your finances. A financial advisor may also help you understand your current financial situation. Still confused about the concept of takaful? Your takaful advisor will help you choose the most suitable takaful package for you.

You can try asking questions such as “how can I adjust my contributions based on my budget” or “Will medical repricing interfere any of my takaful certificate?”. We encourage you to ask any questions that come across your mind, even if it is a small matter. By having professional advisors, you can make a wiser decision in planning your financial future.

In conclusion, it is important for you to remember that medical takaful repricing is a common process in the takaful industry. With an accurate understanding and wise decisions, you can manage these repricing efficiently. Always be aware with the general takaful repricing, consider your financial plannings and don’t hesitate to seek for advice if needed. These steps not only bring you tranquillity, but can help you manage your future with ease. With these, you can ensure that your health protection remains in good quality while managing the stability of your finances.