Key benefits

-

An affordable hibah takaful plan with a high coverage from RM250,000 Sum Covered

Get protection with high Sum Covered from RM250,000.

-

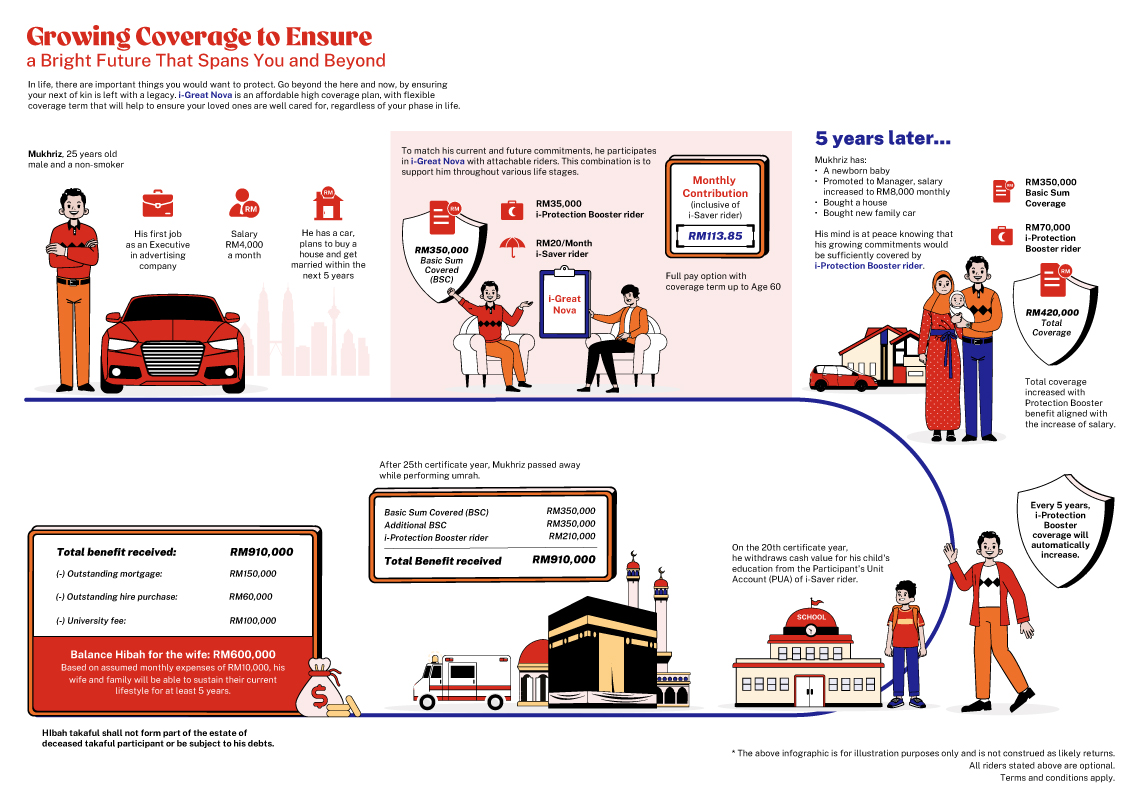

Optional Automatic Increase of Sum Covered Every 5 Years

Customise your hibah takaful plan i-Great Nova with an optional i-Protection Booster Rider that provides additional rider sum covered upon death or TPD of person covered that auto-increases every 5 years up to 1000% of the rider sum covered.

-

Protect Your Legacy with Coverage Term up to Age 80

Be covered up to age 60, 70 or 80 and have the flexibility of choosing contribution payment term between 10, 20 years or throughout the coverage term based on your affordability.

-

i-Saver Rider

95% of contributions payable under this rider will be allocated to Participant’s Unit Account for savings and investment purposes, where you can opt from the funds available.

-

Additional Death Benefit during Hajj/Umrah

Upon non-accidental death of the person covered while performing Hajj or Umrah, an additional amount of 100% of Basic Sum Covered will be payable on top of the Death Benefit.

How i-Great Nova works

Let us match you with a qualified Takaful advisor

Our Takaful advisor will answer any questions you may have about our products and planning.

How can we help you?

Understand the details before participating

- i-Great Nova is a regular contribution Term Family Takaful plan that provides coverage upon Death or Total & Permanent Disability (TPD) of the Person Covered. Additional Compassionate Benefit of RM2,000 will also be payable upon death of the Person Covered.

- Age refers to age next birthday. Contributions are payable following the contribution payment term – limited-pay or full-pay, or upon death or TPD of the Person Covered, or termination of the certificate, whichever occurs first. Upon activation of Auto-Extension of coverage, new contributions will be required.

- You may stop paying contributions and still enjoy protection as long as there are sufficient amount of money in the Participant's Individual Account (PIA), Participant's Unit Account (PUA) of Basic Plan or PUA of i-Saver Rider (if applicable) to pay for the Tabarru', where applicable. However, there is a possibility of certificate lapsing when the required charges, including Tabarru’, exceed the money available in PIA, PUA of Basic Plan and PUA of i-Saver Rider (if applicable).

- You should be convinced that this plan will best serve your needs and that the contributions payable under the Certificate are affordable to you.

- A “Free-Look Period” of 15 days from the date you acknowledge your e-certificate through i-Get In Touch is given for you to review the suitability of the plan. If the Certificate is returned to the Takaful Operator during this period, the Takaful Operator shall refund the following minus medical expenses (if any): (i) Total Takaful Contribution, if any; (ii) Total Account Value of this Certificate at unit price at the next valuation date, if any, and (iii) Unallocated i-Great Nova Saver Contribution.

- You may receive the remaining amount in PIA, PUA of Basic Plan or PUA of i-Saver Rider (if any) upon termination or maturity of this plan, which may be less than the total allocated contribution into the PIA, PUA of Basic Plan or PUA of i-Saver Rider (if any). No benefits will be payable from the Tabarru’ Fund.

- The amount of PIA, PUA of Basic Plan or PUA of i-Saver Rider (if any) will be based on actual performance of the fund and is not guaranteed. Depending on the fund's performance, the PIA, PUA of Basic Plan or PUA of i-Saver Rider (if any) amount may decrease and the certificate may potentially lapse. The investment risks under this plan will be borne solely by you and the PIA, PUA of Basic Plan or PUA of i-Saver Rider (if any) may be less than the total contributions contributed to the funds.

- Participating in a Family Takaful plan is a long-term financial commitment. If you do not pay your contributions within the grace period of 30 days, your Certificate may lapse. The accumulated cash value from PIA and Total Account Value from PUA of basic plan and PUA of i-Saver rider that you may get when you cancel the Certificate before maturity period will be much less than the total amount of contribution that you have paid.

- If you switch your Certificate from one Takaful Operator to another or if you replace your current Certificate with another Certificate within the same Takaful Operator, you may be required to submit an application where the acceptance of your proposal will be subject to the terms and conditions to be imposed at the time of switching or replacement.

This information merely provides general information only and is not a contract of Family Takaful. You are advised to refer to the Benefit Illustration, Product Disclosure Sheet and sample Certificate for detailed features and benefits of the plan before participating in the plan.

Great Eastern Takaful Berhad is a member of PIDM. The benefit(s) payable under eligible certificate/product is (are) protected by Perbadanan Insurans Deposit Malaysia (PIDM) up to limits. PROTECTION BY PIDM ON BENEFITS PAYABLE FROM THE UNIT PORTION OF THIS CERTIFICATE/PRODUCT IS SUBJECT TO LIMITATIONS. Please refer to PIDM’s Takaful and Insurance Benefits Protection System (TIPS) Brochure or contact Great Eastern Takaful Berhad or PIDM (visit www.pidm.gov.my).