Latest announcements, updates and news

Operating Hour During Ramadan (Fasting) Month

During the Ramadan month, the operating hours for the GETB Careline and Support Counter, Level 3 are as follows:

| Service | Operating Hours |

|---|---|

| Call Centre | 8:30am – 4:45pm |

| GETB Support Counter (Level 3, MGE) | |

| Servicing Centres (HQ & Branches) | 8:30am – 5:15pm |

Thank you for your understanding and continued support. We wish you blessed Ramadan!

Operating Hour During Chinese New Year

Great Eastern nationwide Customer Service Centres and the Customer Service Careline will be closed from 16/2/2026 (Monday) at 1:00PM to 18/2/2026 (Wednesday) in conjuction with the Chinese New Year celebration. Business will resume as usual on 19/2/2026 (Thursday).

In addition, selected Customer Service Centres inlcuding Alor Setar, Johor Bahru, Batu Pahat, and Kluang will remain closed until 19/2/2026 (Thursday) in observance of Awal Ramadan. Business will resume on 20/2/2026 (Friday). Thank you for your understanding and we wish you a wonderful Chinese New Year!

Important Notice: BPA System Migration in Progress

Please be informed that the Biro Perkhidmatan Angkasa (BPA) system is currently undergoing a scheduled migration to enhance our services and improve your experience.

The new system is expected to go live on 17th June 2025. During this transition period, you may experience longer processing times for registration and payment-related services. To ensure uninterrupted service and avoid potential delays, we strongly encourage all clients to use Credit Card or Debit Card as an alternative payment method.

Thank you for your continued support.

2024 Investment-Linked Funds Report Now Available

GETB’s Investment-Linked Funds Annual Report for the Year 2024 has been uploaded in the corporate website and our customer portal, i-Get In Touch (iGIT).

You may obtain the document in our corporate website here.

Alternatively, you can also view the same report via iGIT portal by following the path: My Portfolio > Reports & Updates

If you have not registered as an iGIT user, and would like to enjoy the convenience of printing your own statement(s) and other services, register here.

For more information on how to download the statement from iGIT, please refer to ‘How to Download Statements’.

Should you require further clarification please contact our Customer Service Officer at 1 300 13 8338 or email us at i-greatcare@greateasterntakaful.com.

2024 Contribution Statements are Now Available

The Family Takaful Contribution Statement, Family Takaful Contribution Statement (Group) Investment-Linked Statement and Participant Individual Account Annual Statement (PIA) for year 2024 are now available in i-Get In Touch (iGIT). Login to view and download your statements under My Document.

Kindly clear your device’s cache and cookies to ensure smooth statement viewing and downloading process.

Revised Operating Hours During Fasting Month

In conjunction with the month of Ramadhan, we wish to inform you that the operating hours of our Customer Care Centre at Level 3, Head Office and Customer Careline will be revised as follows: -

| Customer Care |

Operating Hours |

| Customer Care Centre, Level 3 | 8:30am to 4:45pm |

| Customer Careline | 8:30am to 4:45pm |

The operating hours of our nationwide Customer Service Centres based in Great Eastern Life Assurance (Malaysia) Berhad remain unchanged as 8:30am to 5:15pm.

Wishing you a productive and fruitful Ramadan Al-Mubarak!

Temporary Suspension of New Direct Debit Authorisation (DDA) Applications

Please be informed that the submission of new Direct Debit Authorisation (DDA) applications will be temporarily suspended effective from 16th January 2025 until further notice.

During this period, you are advised to enrol Credit Card/Debit Card as an alternative payment method via i-Get In Touch (iGIT) portal by following the steps outlined below. Existing DDA recurring billings will remain unaffected.

https://igetintouch.greateasterntakaful.com (i-Get In Touch) > My Service Request > Change Contribution Method > Select new contribution method as Credit Card

Implementation of e-Invoice by the Inland Revenue Board of Malaysia

The Inland Revenue Board of Malaysia (IRB) introduced electronic invoicing known as e-Invoice for all commercial transactions by phases starting 1 August 2024

.e-Invoice is a digital representation of a transaction which allows businesses to electronically send invoices to IRB. This is in line with the Government’s focus on strengthening the digital services infrastructure and to digitalise tax administration.

As for Great Eastern Takaful Berhad, the self-billed e-invoice for certificate benefits payout has been implemented as the phase 1 approach, effective 1 August 2024. Given that the process will also require us to collect a certain mandatory supplier/customer information, hence, we shall reach out to you for the details soon.

In addition, please find our details below for your e-Invoicing purpose:

| GETB Business Registration Number |

201001032332 |

| GETB TIN | C21237867080 |

| GETB SST Registration Number | W10-1809-32000159 |

| GETB MSIC Code | 65112 |

| GETB Business Activity | Family Takaful |

Should you require further information, feel free to click here to view our Frequently Asked Questions (FAQ).

Thank you.

Extended Critical Illness (CI) Coverage

We are pleased to announce that we have extended the Critical Illness (CI) coverage from 45 CI to 50 CI at NO additional cost.

The 5 new critical illnesses covered are as follows:

- Ebola Haemorrhagic Fever

- Severe Elsenmenger’s Syndrome

- Meningeal Tuberculosis

- Rabies

- Severe Haemophilia

The extension of critical illness coverage is applicable for the following current selling products and riders:

Effective 1 May 2024

| Eligible products | Eligible riders |

*Online Takaful plan |

|

Effective 22 July 2024

| Eligible products | Eligible riders |

|

|

Click here to learn more about the List of Covered Critical Illness and here for the definition of the 5 new CIs.

Note: Terms and conditions apply. For more information, please contact your servicing Takaful Advisor.

Advanced Medical Treatments

We are pleased to announce that we have extended the medical treatments covered under the Great Eastern Takaful medical card.

The medical treatments covered are as follows:

- Brachytherapy

- Cryoablation

- Gamma Knife

- Hormone Therapy for cancer

- Immunotherapy for cancer

- Intensity Modulated Radiotherapy (IMRT)

- Neutron Beam Radiation Therapy (NBRT)

- Proton Beam Radiotherapy (PBRT)

- Robotic Prostatectomy

- Stem cells for Hematopoietic Cell Transplant for haematological malignancies

- Targeted therapy for cancer

- Deep Brain Stimulation (DBS)

- JointRep (Cartilage scaffold for knee)

- Vagus Nerve Stimulation (VNS)

Find out more about the above medical treatments here.

Notes:

- The list of advanced medical treatments above is non-exhaustive and subject to periodic revision by Great Eastern Takaful Berhad.

- The coverage is subject to certificate benefits with terms and conditions applied, given the medical condition is not pre-existing/non-disclosure/does not fall under certificate exclusion.

- Great Eastern Takaful Berhad medical plans cover the above treatment procedures and drugs that have been approved by the Ministry of Health (MOH), Malaysia and the Food and Drug Administration (FDA), United States. Any treatment or drug which is still under clinical research or trial will NOT be covered, and any external implantable prosthetic devices/appliances not limited to the above treatments will NOT be covered as per certificate exclusion.

- The advanced treatments listed above will be covered under Great Eastern Takaful Berhad medical plans only if they are deemed medically necessary and are justified by the treating physician to be the most optimal treatment in patient's best interest, subject to the terms and conditions as per outlined in the certificate document.

- For enquiries, please call our Customer Careline at 1300-13-8338, or email us at i-greatcare@greateasterntakaful.com.

Net Asset Value (NAV) for Investment-Linked Funds

Dear Valued Customers,

Please be informed that the latest NAV for all Investment-Linked Funds are available in GETB’s website.

You may click here for the NAV mentioned above and here for the latest Fund Fact Sheet of each Investment-Linked Funds.

Should you require further clarification, please contact our Customer Service Officer at 1-300-13-8338 or email us at i-greatcare@greateasterntakaful.com.

Download Your Statement via i-Get In Touch (“iGIT”)

The Family Takaful Contribution Statement, Family Takaful Contribution Statement (Group), Investment-Linked Statement and Participant Individual Account Annual Statement (PIA) for year 2023 are now available in iGIT. Login to view and download your statements under My Documents.

Kindly clear your device’s cache and cookies to ensure smooth statement viewing and downloading process.

Service requests via iGIT

Effective from 1st August 2023, we will only accept online updates via i-Get In Touch (“iGIT”) for the following service requests:

- Sign-up for auto-debit of renewal contribution from credit/ debit card (Easi-Pay Service)

- Change of certificate payment method or mode

- Change of address, contact number & email

- Registration of bank account for direct credit facility

- Investment fund switching

- Appointment of nominee / executor

- Car registration for car assistance program (only applicable for selected plans)

- Other Customer Service Request Form Submission

You may refer to the guide to ease your online submissions via iGIT here.

Note: Please upload all kinds of documents through i-Get In Touch. Effective from 1st August 2023, we will not accept any submission of documents through email and branches.

Introducing GET-SME

We are delighted to announce the launch of GET-SME, a revitalised model of Group SME Package product, on 31st March 2023. This innovative new offering is designed to provide cost-effective coverage value that caters to the needs and preferences of our customer.

GET-SME introduces an additional Extended Coverage for COVID-19 rider under Group Hospitalisation & Surgical (GHS) product and an improved rate for GHS, aimed at delivering enhanced value to our customers, particularly those in the younger segment. We are confident that these initiatives prove to be invaluable to our customers in today's challenging times.

GET-SME is a pre-packaged Group Yearly Renewable Contribution Term Takaful plan without the Participant’s Individual Account (PIA) model, which is designed to meet the requirements of the small company or organization (i.e. Small and Medium Enterprise - SMEs) by providing adequate coverage for the employees or members on a compulsory participation basis.

At Great Eastern Takaful Berhad, we aim to provide the best protection for the most valuable asset in an organisation which are the employees and/or their family members.

For more information, please email us at i-greatcare@greateasterntakaful.com.

Thank you for your continuous support.

2022 Family Takaful Contribution Statement and Annual Statement Are Available Now!

Dear Valued Certificate Owner,

We are pleased to inform you that Family Takaful Contribution Statement (FTCS), Investment-Linked (ILP) Statement, ILP Sustainability Letter and Participant’s Individual Account Statement for the Year 2022 are available for download via i-Get In Touch (“iGIT”).

The statements are in Portable Document File (PDF) format for viewing and downloading. In-line with our GETGreen initiative, there will be no more hardcopy of statements to be sent and you may view the statements up to the last five (5) years via iGIT.

If you are an existing iGIT user, please click here to log on to iGIT to retrieve a copy of your statement(s).

If you have not registered as an iGIT user, click here to register as iGIT now. We encourage you register to enjoy the convenience of printing your own statement(s) and other services.

For more information on how to download the statement from iGIT, please refer to ‘How to Download Statements’ guide.

iGIT is a one-stop self-service portal by Great Eastern Takaful that allows our customers to get access to Certificate details and perform online transactions.

You may use this portal to access your Takaful plan. You can manage your Takaful Certificate by updating your personal details, nominating beneficiaries and executor, view and download letters and many more. you may also get a holistic view of your protection portfolio to understand your protection gap and plan wisely for your future.

Should you require further clarification, please contact our Customer Service Officer at 1 300 13 8338 or email us at i-greatcare@greateasterntakaful.com.

Thank you.

Removal of Charity Clause

Dear Valued Customer,

Please be informed that the Charity Clause whereby any excess amounting less than RM10 which was channelled to charity fund, will be removed with immediately effect.

With the removal of the Charity Clause, any excess amount will be refunded to our customers. You may update your bank details in i-Get In Touch (“iGIT”) for refund purposes if any. If the excess amount is not refunded after one year due to no banking details, we will channel the said excess amount to Unclaimed Money.

iGIT is a one-stop self-service portal by Great Eastern Takaful that allows our customers to get access to Certificate details and perform online transactions.

To update your bank details, please click here to log in to our iGIT.

Thank you.

Providing Authorisation For Card-Not-Present (CNP) Debit Card Transactions Before Register For Auto-Debit Deduction

Dear Valued Customer,

In order to further strengthening the security measures for online transaction, Bank Negara Malaysia (“BNM”) requires all debit card users to contact their issuing bank to authorise for Card-Not-Present (“CNP”) Debit Card transaction before registering for any auto-debit deduction of contribution. As such, if you currently using or planning to use debit card for auto-debit deduction service, please perform the following steps to avoid unsuccessful deduction for the recurring auto-billing service.

Step 1: Customer contacts their debit card issuing bank’s customer service care line or visits any of the issuing bank’s branch. Customer authorises the issuing bank to allow Great Eastern Takaful Berhad’s certificate contribution deduction (auto-debit billing) from their debit card.

Example: I want to activate / op-in to perform CNP transaction for my debit card for Great Eastern Takaful Berhad’s certificate monthly contribution deduction (insurance premium deduction).

Step 2: Customer follows card issuing bank’s instruction to complete the verification for the request.

Step 3: Customer checks the following items with card issuing bank to ensure debit card setting is valid for certificate contribution deduction:

- Check the daily deduction limit to ensure maximum daily limit impose sufficient for certificate contribution deduction

- Any default setting on the debit card disallowed certificate contribution deduction

Step 4: Customer enrols debit/ credit card contribution method via i-Get In Touch for the certificate.

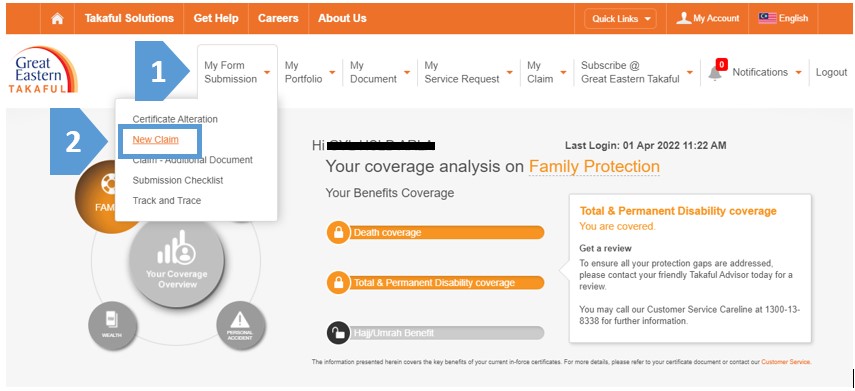

New Facilities Available in i-Get In Touch Portal for Both Claims and Certificate Alterations

Dear Valued Certificate Owner,

We are pleased to share three (3) important new facilities available in i-Get In Touch (“iGIT”) with immediate effect.

1. New Claims Documents Submission

You may follow the steps as per the screenshots below to submit a new claim:

iGIT > My Form Submission > New Claim

You may also refer to Claim Form Submission Guide.

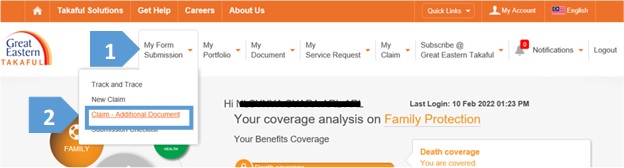

2. Additional Claim Documents Submission

You may follow the steps as per the screenshots below to submit additional document for claim:

iGIT > My Form Submission > Claim – Additional Document

You may also refer to Claim Form Submission Guide.

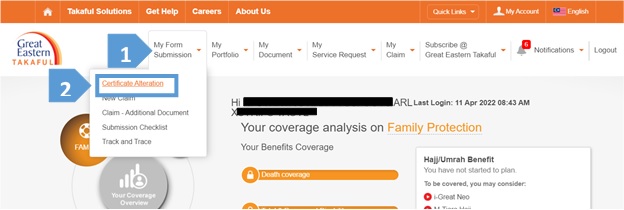

3. Certificate Alteration Documents Submission

You may follow the steps as per the screenshots below to perform certificate alteration:

iGIT > My Form Submission > Certificate Alteration

You may also refer to Certificate Alteration Guide.

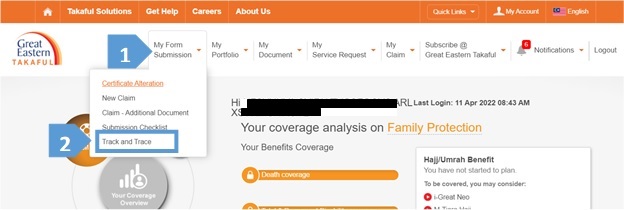

Please be informed that you can track the status of all online form submissions through the iGIT portal. You may follow the below steps:

iGIT > My Form Submission > Track and Trace

Still don’t have Great ID account?

Don’t worry, you may visit i-Get In Touch portal, and then click “Register now” to start registering your account.

For more information pertaining to i-Get In Touch, please refer to user guide on our corporate website.

2021 Family Takaful Contribution Statement and Annual Statement Are Available Now!

Dear Valued Certificate Owner,

We are pleased to inform you that Family Takaful Contribution Statement (FTCS), Investment-Linked Statement (ILP) and PIA Statement for the Year 2021 are available for download via i-Get In Touch (“i-GIT”).

The statements are in Portable Document File (PDF) format for viewing and downloading. In-line with our GETGreen initiative, there will be no more hardcopy of statements to be sent and you may view the statements up to the last five (5) years via i-GIT.

If you are an existing i-GIT user, please click here to log on to i-GIT to retrieve a copy of your statement(s).

If you have not registered as an i-GIT user, click here to register as i-GIT now. We encourage you register to enjoy the convenience of printing your own statement(s) and other services.

For more information on how to download the statement from i-GIT, please refer to ‘How to Download Statements’ guide.

i-GIT is a one-stop self-service portal by Great Eastern Takaful that allows our customers to get access to Certificate details and perform online transactions.

You may use this portal to access your Takaful plan. You can manage your Takaful Certificate by updating your personal details, nominating beneficiaries and executor, view and download letters and many more. you may also get a holistic view of your protection portfolio to understand your protection gap and plan wisely for your future.

Should you require further clarification, please contact our Customer Service Officer at 1 300 13 8338 or email us at i-greatcare@greateasterntakaful.com.

Thank you.

Closure of Great Eastern Payment Counters Nationwide Effective 1st February 2022

Dear Valued Customers,

In view of the wide-ranging contribution payment options that are available to our certificate owner today, please be informed that the payment counters located at Great Eastern offices nationwide will be closed permanently effective on 1st February 2022. For more information on the alternative certificate related payment options, please refer to Contribution Payment Facilities.

Thank you.

Assistance for GETB's Flood Affected Customers

Dear Valued Customers,

We understand that these are tough time. While we continue to battle with the Covid-19 Pandemic, several states in the country were badly hit by floods recently. Our thoughts and prayers are with you and your families. We are here to assist you

- Restructure contribution payment mode from annually to monthly basis and

- Extend deferment of contribution payment until 31 January 2022

- Waiver fee and charges for service requests such as reprinting of certificate document and medical card, if required, as well as withdrawal (where applicable) until 31 January 2022

Effected customer are advised to contact our Customer Service Careline 1-300-13-8338 or their servicing agent or email to i-greatcare@greateasterntakaful.com for assistance.

New Infographic on the Auto-Extension Feature

Dear Valued Customers,

We are pleased to inform you that we have developed an Infographic on Auto-Extension Feature to give you a clearer picture on how the feature would complement your Takaful plan(s). You may also check out the Frequently Asked Questions in the Infographic for further details. We have prepared this document in both languages, English and Malay for your ease of reference.

You may click here for the infographic mentioned above.

For further assistance, please call 1 300 13 8338 or email i-greatcare@greateasterntakaful.com.

Thank you.

Notice on i-Get In Touch self-servicing wef Sept 1

Dear Customer,

For your convenience and safety, and to support the sustainability of the environment, these services will be fully online on our self-service portal i-Get In Touch from September 1, 2021:

- Change Contribution Method / Frequency

- Update Account Number/ Profile

To learn more, please visit here or contact your servicing takaful agent.

New Fund Objective for Investment-Linked Fund - Dana i-Mekar

Dear Valued Customers,

We are pleased to announce that effective from 1st September 2021, the fund objective for Investment-Linked Fund – Dana i-Mekar is revised as follows:

| Current Fund Objective |

New Fund Objective (effective 1 September 2021) |

| A fund where investments are in Shariah-compliant equities (ranging from 80% to 100%), which may be volatile in the short term, as well as Islamic deposits. This fund seeks to achieve medium to long-term capital appreciation. Although the fund invests mainly in Malaysia, it may partially invest in Singapore (up to 25%) and Hong Kong (up to 25%), if and when necessary, to enhance the fund’s returns. Dana i-Mekar only invests in Shariah-compliant securities. | A fund where investments are in Shariah-compliant equities (ranging from 80% to 100%), which may be volatile in the short term, as well as Islamic deposits. This fund seeks to achieve medium to long-term capital appreciation. Although the fund invests mainly in Malaysia, it may partially invest in Singapore (up to 25%) and Greater China (Mainland China, Hong Kong, Macau and Taiwan) (up to 25%), if and when necessary, to enhance the fund’s returns. Dana i-Mekar only invests in Shariah-compliant securities. |

This change aims to allow the fund to participate in stocks that provide a better representation of the China economy as well as to provide more opportunities for the fund to boost performance for certificate holders.

Please be assured that the updates WILL NOT AFFECT any of your customer’s existing Takaful benefits as well as it will not incur any additional Contribution and other charges.

For more details, please click here for FAQ and here for the latest Fund Fact Sheet of Dana i-Mekar.

Should you require further clarification, please contact our Customer Service Officer at 1 300 13 8338 or email us at i-greatcare@greateasterntakaful.com

Thank you.

Documents available on i-Get in Touch from 1 April 2021

Dear Valued Customers,

GETB continues to protect the environment!

From 1 April 2021, these letters and/or notifications will be available on our self-service portal i-Get in Touch:

- Letter on contribution payment method & frequency alteration

- Letter on partial withdrawal

- Letter on change of nominee, address, personal details, contribution due notice

- Short Payment Notice

- ILP Surrender Statement, etc.

Please refer to our tutorials here or call 1 300 13 8338 for assistance.

e-Statements for 2020

Dear Valued Customer,

We are pleased to inform that the following statements are available in the customer portal, i-Get In Touch:

- Family Takaful Contribution Statement (FTCS)

Certificate owner’s contributions paid statement which can be used to claim for tax relief - Investment-Link (IL) / PIA Annual Statement

A statement sent to Certificate owner on the value of his / her certificate on a yearly basis - ILP Annual Sustainability Notice

A statement that give information on factors that may reduce the fund value of the certificates

The e-statements are in Portable Document File (PDF) format and you can access up to the last 5 years’ statements. The e-statements are applicable to certificate issued under Agency, Bancatakaful and Group Takaful.

There will be no more hard copy of statements sent to you.

If you are a new user, please click here for registration. You may login if you are an existing user.

You may learn more about how i-Get in Touch can simplify your financial protection management and refer to the tutorials available here.

Should you require further clarification, please contact our Customer Service Officer at 1 300 13 8338 or email us at i-greatcare@greateasterntakaful.com.

Thank you.

Register & Migrate to e-Payment and Win Up to RM5,000 e-Voucher

Dear Valued Customers,

i-Get In Touch NOW offers accelerated e-Payment services.

What does this mean to YOU?

- Stay safe and use the services 24/7, anytime, anywhere

- You are authenticated via secured login – ONLY YOU can do any updates to your certificate

- Access information and view transaction status at your fingertips

- Receive payout promptly into your bank account

- Simpler and hassle-free process

Thank you for supporting and using the facilities in i-Get In Touch to ease your financial protection management.

From 15 February to 14 April 2021, stand a chance to win Touch ‘n Go e-voucher up to RM5,000 when you register and perform one e –payment transaction. Read the terms & conditions for the Register i-Get In Touch & Migrate to e-Payment here.

You may learn more about how i-Get In Touch can simplify your financial protection management and refer to the tutorials available here.

Update: Campaign ended on 12 March 2021, 2:16pm.

New Infographic on the Takaful Operational Model

Dear Valued Customers,

Great News! We have developed a new Infographic on Takaful Operational Model to give you better understanding on how the Takaful business really works. We have prepared this document in both languages, English and Malay for your ease of reference.

To make things clearer and more consistent, we have updated our existing Takaful Operational Model in relation to the deduction of the Upfront Charge (Wakalah Fees) as at Nov 2020. The Upfront Charge applicable (if any) will be deducted from respective Participants Funds. Participants Funds shall refer to the Participant’s Individual Account (PIA), or Participant’s Unit Account (PUA), whichever applicable. In the event where there is no existence of the accounts mentioned above, the Upfront Charge will be deducted from Tabarru’ Fund.

Please be assured that the updates WILL NOT AFFECT any of your existing Takaful benefits as well as it will not incur any additional Contribution, Tabarru’ rate, fees and charges.

For more details, please click here.

For further assistance, please call 1 300 13 8338 or email i-greatcare@greateasterntakaful.com.

Thank you.

New e-Documents Available In i-Get In Touch

Dear Valued Customers,

We are pleased to announce that we will no longer be sending hard copy of the following documents and letters to you. This is in line with our effort to go green and to further enhance the facilities offered in the i-Get in Touch portal.

- Pre-Lapse & Lapse Letter

- Surrender Letter

- Certificate Reinstatement

- Unsuccessful Contribution Deduction Notifications on GIRO/DDA/Credit Card

You may click here for steps to retrieve the e-documents or letters via i-Get In Touch.

For further assistance, please call 1 300 13 8338 or email i-greatcare@greateasterntakaful.com.

Thank you.

Tax Relief 2019

Dear Valued Customers,

In line with the recent announcement by the Inland Revenue Board of Malaysia on separation of tax relief, we are delighted to announce that the tax relief 2019 for Family Takaful and Employees Provident Fund (EPF) contribution has been revised from RM6,000 to RM7,000.

For individuals outside the pensionable public servant category, tax relief for Family Takaful is restricted to RM3,000 while contribution to the EPF or approved scheme is entitled to a restricted tax relief of RM4,000. Meanwhile, individuals in the pensionable public servant category are entitled to a restricted RM7,000 tax relief for the Family Takaful contributions.

We hope that the new initiative by the Inland Revenue Board of Malaysia is beneficial to you and would encourage you to always get protected.

Don’t forget to download your Family Takaful Contribution Statement for the year 2019 here.

Note: Tax benefits are subject to the Malaysian Income Tax Act 1967 and final decision of the Inland Revenue Board of Malaysia.

Change of Deduction Schedule For GIRO And DDA Payment Method

Dear Valued Customers,

In order to ensure the timely collection of your contribution and keep your coverage in place, with effective from 16 November 2020, the schedule of auto billing for GIRO (Auto Debit) and Direct Debit Authorization (DDA) payment method will be revised base on the due date of your certificate. The details of the revision of auto deduction of contribution from customers’ bank account are shown below:

| Old Practice | New Practice | ||

| Before 16 November 2020 | With effective from 16 November 2020 | ||

| Certificate Due Date | Deduction Date | Certificate Due Date | Deduction Date |

| 1st of the month –End of the month | 1st deduction attempt = 28 of the month 2nd deduction attempt = 9 of the following month (if 1st attempt is unsuccessful) |

1st of the month – 15 of the month | 1st deduction attempt = 9 of the month 2nd deduction attempt = 28 of the month (if 1st attempt is unsuccessful) |

| 16 of the month – End of the month | 1st deduction attempt = 28 of the month 2nd deduction attempt = 9 of the following month (if 1st attempt is unsuccessful) |

||

*For DDA & BSN GIRO– the deduction will take place on the following working days if 9th and 28th fall on Public Holiday or weekends.

If you suspect any unauthorised contribution deduction has been made to your account, or other irregularities concerning your contribution deductions, you should notify your bank and Great Eastern Takaful Berhad immediately.

For further assistance, please call 1 300-1383 38 or email i-greatcare@greateasterntakaful.com.

Introducing GET-REV

Dear Valued Customers,

We are pleased to inform you that a new Group Takaful scheme, GET-REV, will be launched on 1 Nov 2020 as part of our continuous efforts in providing our customers with added innovative features with the best and affordable coverage possible:-

- Comprehensive & Flexible Coverage:

- Death

- Total & Permanent Disability

- 45 Critical Illnesses

- Personal Accident

- Hospitalisation & Compassionate Benefits

GET-REV will supersede the current products namely Group Multiple Takaful Scheme (GMBTS) effective 1 October 2020 and Group Protection Takaful (GPT) upon expiry. Please rest assured that the existing GMBTS customers may continue to enjoy their existing GMBTS coverage, and the GPT customers will be offered with GET-REV upon certificate renewal.

At Great Eastern Takaful Berhad, we aim to provide the best protection for your most valuable asset in the organisation which is your Employees and/or their family members.

For more information, please reach out to your Business Managers or Corporate Agents or email us at i-greatcare@greateasterntakaful.com.

Thank you for your continuous support.

i-Get In Touch Login with Great ID

Dear Valued Customer,

We are pleased to announce that effective 8 August 2020, Great Eastern Takaful Berhad (GETB) is introducing Great ID, a new single sign-in identity for our Customers.

With Great ID, you will adopt and use it to manage all your logins to access digital services and applications for both Great Eastern Takaful certificates and Great Eastern policies (if applicable).

All you need is to have a valid e-mail address to create your respective Great ID, which will replace your existing login ID for the current i-Get In Touch portal.

Click here to view steps to create Great ID for both existing and new users of i-Get In Touch.

You may also check out Great ID Frequently Asked Questions here.

For more info about i-Get In Touch, please click here.

Thank you.

Preventive Steps at Great Eastern Takaful In Response to the Coronavirus Situation (2019-nCOV)

Dear Customer,

The recent update received from the Ministry of Health on 12th February 2020 has stated that the Coronavirus situation, now termed as 2019-nCoV in Malaysia is being continuously monitored. Our customers & colleagues are our top priority. The Customer Careline services operate as usual at 1300 13 8338 (the Interactive Voice Response System is ready to assist anytime). You can reach us through our general line +603 4259 8338 (8.30am-5.15pm weekdays), or you can email us on i-greatcare@greateasterntakaful.com.

We have taken initiatives to ensure regular sanitisation of common areas of the offices as well as the furniture. Protective face masks and hand sanitizers have been distributed to all departments for necessary use. To contain the risk of infection and virus spread, we have also put in place temperature screening for all visitors at our customer service centres & every entry point of offices. Visitors will be asked to fill in relevant health declarations to facilitate contact tracing procedures in case information is later required. We seek your full cooperation with our staff, and thank you for your patience and understanding.

With the interest of public health in mind, we strongly advise you to refrain from visiting our centres should you be unwell, or if you have travelled to/from affected regions, have relatives/friends serving LOA/quarantines. If you have flu symptoms or register a fever, you are highly encouraged to seek immediate medical attention.

Please call/email us for further assistance.

Thank you for your support. We will continue to provide updates regarding the health situation provided by the government.

SHAHRUL AZLAN SHAHRIMAN

Chief Executive Officer