Key benefits

-

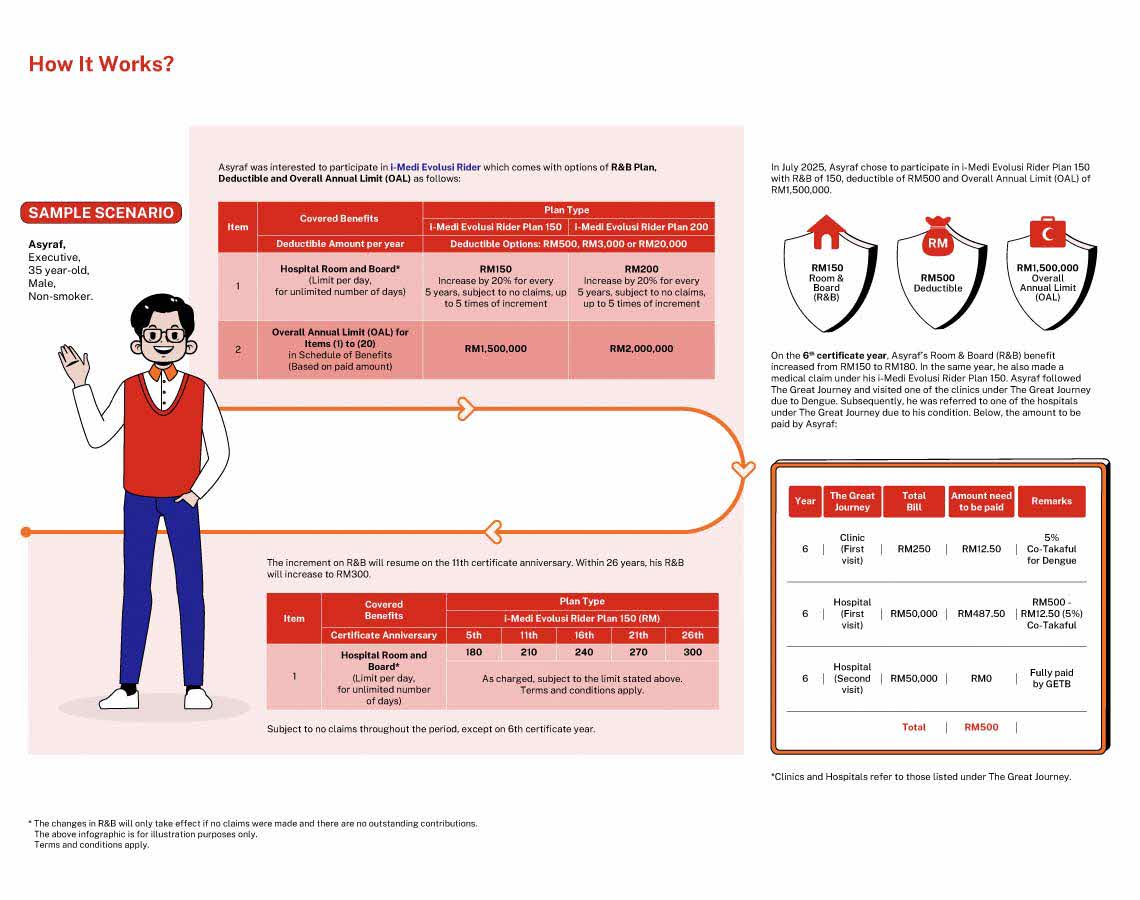

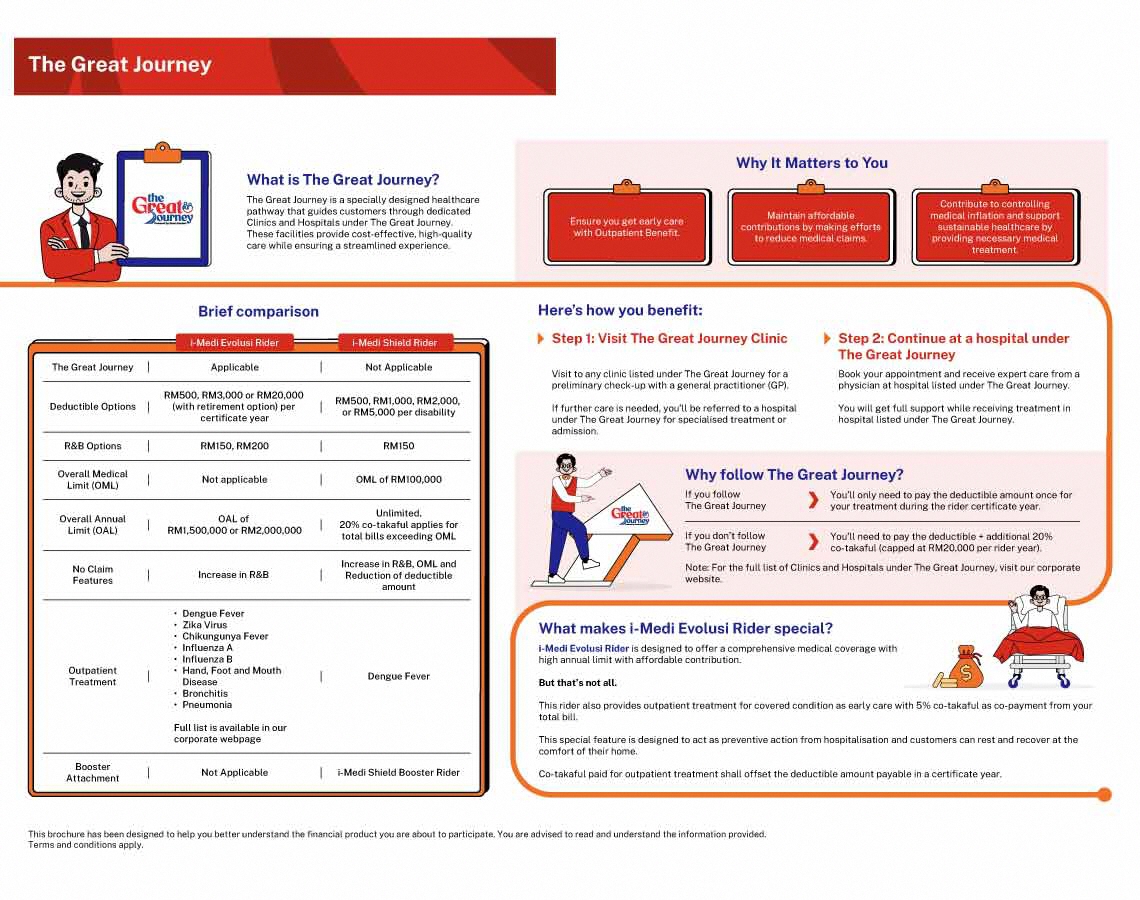

Offering a seamless and supportive healthcare experience with The Great Journey

With a seamless and supportive healthcare experience through a network of dedicated Clinics and Hospitals under The Great Journey, delivering high-quality care at lower costs, with personalized guidance every step of the way.

Click here to know more

-

High Overall Annual Limit (OAL) up to RM2 million

Get a High Overall Annual Limit of (OAL) RM1,500,000 or RM2,000,000 and manage unexpected medical expenses with confidence.

-

Deductible Option

Deductible Amount option will be offered under this plan with RM500, RM3,000 and RM20,000 with retirement option.

-

8 Main Outpatient Treatments

Get covered for other outpatient treatments such as:

- Dengue Fever- Zika Virus

- Chikungunya Fever

- Influenza A & B

- Hand, Foot and Mouth Disease

- Bronchitis

- Pneumonia.

Let us match you with a qualified Takaful advisor

Our Takaful advisor will answer any questions you may have about our products and planning.

How can we help you?

Understand the details before participating

Terms and conditions apply. The info above merely provides general information only and is not a contract of family Takaful. You are advised to refer to the benefit illustration, Product Disclosure Sheet and sample certificate for detailed features and benefits of the plan before participating in the plan.

Great Eastern Takaful Berhad is a member of PIDM. The benefit(s) payable under eligible certificate/product is (are) protected by PIDM up to limits. Please refer to PIDM’s TIPS Brochure or contact Great Eastern Takaful Berhad or PIDM (visit www.pidm.gov.my).