What is takaful rider?

Takaful riders are optional, which can be attached to your basic Takaful plan. It offers added benefits and protection that the basic plan may not cover. When you’re selecting a for yourself or your loved ones, don’t just compare the benefits of the basic plan, but the benefits that the riders offer too. Discover the types of riders available.

So you are already aware of the importance of Takaful trust and have decided which plan suits your needs and budget. But as you research further, you found that some of these Takaful plans also come with riders. What is a Takaful Rider? Do you have to pay more for them? Most importantly, do you need them?

Takaful riders are optional, which can be attached to your basic Takaful plan. It offers added benefits and protection that the basic plan may not cover. When you’re selecting a for yourself or your loved ones, don’t just compare the benefits of the basic plan, but the benefits that the riders offer too. Some Takaful plans come pre-packaged with its attachable riders, but you have the option to customise your plan according to your needs too.

Of course all good things come with a price. Riders do not come free and the cost will be added into your total contribution. Generally, there are many types of riders available to enhance your basic Takaful trust coverage according to your needs. Most common ones are Healthcare, Critical Illness, Accidental and Term Takaful Riders. Let’s find out what these riders offer and why do you need it:

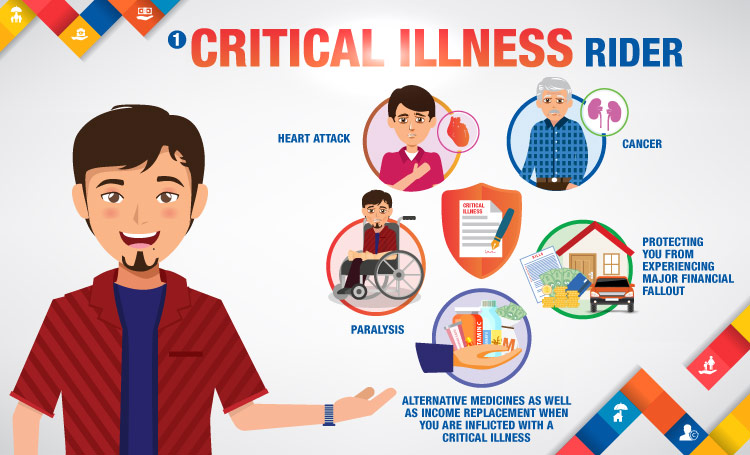

Critical illness rider

Not many are aware that medical protection may not cover some critical illness treatment expenses. If you are diagnosed with a critical illness, chances are the costs will affect not only your emotional, but your financial as well. The critical illness rider generally extends medical coverage for illnesses like heart attack, cancer, paralysis and other illnesses covered by the plan. Do look for the number of critical illnesses covered by the plan, as some might cover only the basic illnesses whilst some plans cover extensively up to 45 critical illnesses. A few of Takaful Trust Operators also extend coverage of 11 critical illnesses for children. It might be something you need to look for before adding a critical illness rider into your basic plan so you would have a comprehensive Takaful protection not only for yourself, but for your loved ones as well.

Critical Illness Rider goes a long way in protecting you from experiencing major financial fallout. It provides one lump sum payment if you are diagnosed with one of the covered critical illnesses. This would definitely help you with recovery treatments, alternative medicines as well as income replacement should you be unable to work to earn an income when you are inflicted with a critical illness. You may use the payout however you wish, to ensure your family’s survival and for you to focus on your recovery.

There are also a few types of Critical Illness Riders available in the market. Some would terminate your term Takaful once you receive the one lump sum payout upon diagnosis, while others would decrease your Basic Sum Covered. This of course varies from one plan to another. Check out our varieties of critical illness rider to suit your needs.

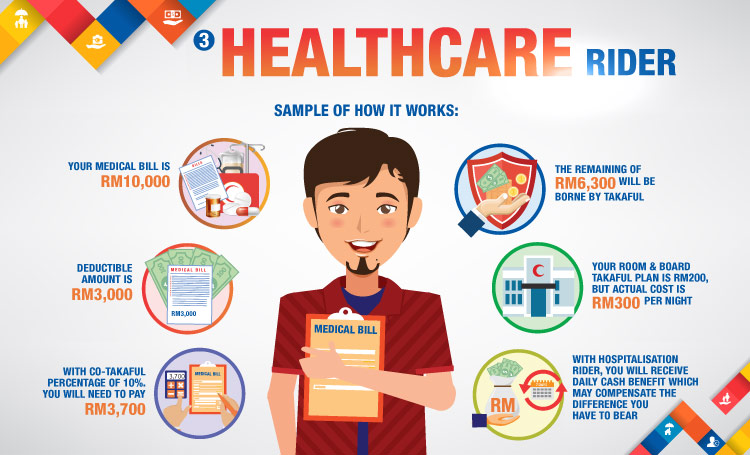

Accidental death or accidental disability rider

Accidental Death Rider provides additional Sum Covered if the Person Covered dies due to an accident. It is best suited for those who wish to leave their families a substantial sum of money in case of a sudden accidental death. There has been a misconception, where many thought that they will not receive the Sum Covered if death does not happen due to an accident. This is definitely not true. The Accidental Death Rider is supplementary to your Basic Sum Covered.

For example, your Basic Sum Covered is RM100,000 and you attached an Accidental Death Rider of RM50,000. If your demise is not due to an accident, your next-of-kin will receive a payout of RM100,000 and if your demise is due to an accident, they will receive a total of RM150,000. Since accidental death may involve higher medical expenses and unfulfilled financial liabilities, your family may use the extra payout from the rider as a financial relief.

Just like Accidental Death Rider, the Accidental Disability Rider provides similar benefit, which is coverage in the event of total and permanent disability, permanent or temporary disability which are caused solely and directly from an accident. However, you need to be aware of the payment method for this rider, as it varies from one Takaful Trust Operator to another, depending on the rider offered.

Most often, Accidental Disability Rider is paid in staggered, which is a percentage of the total Sum Covered each year, usually 10% or more. However, there are some Takaful Trust Operators that offer increasing percentage Sum Covered each year, which can be used to compensate for loss of regular income that may arise due to total and permanent or partial disability suffered by the Person Covered. Check out an comprehensive Accidental Death and Disability Rider by Great Eastern Takaful which offers 5% of the initial rider Sum Covered every year up to a maximum of 150% of the initial rider Sum Covered.

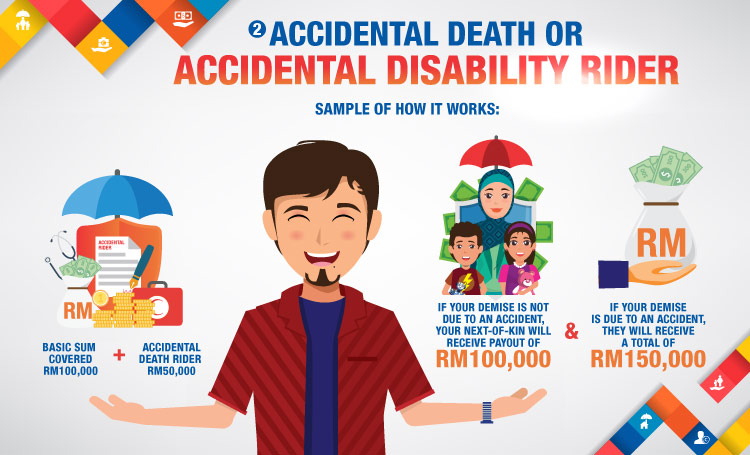

Healthcare rider

There are plenty of Healthcare Rider in the market. It is amongst the most popular riders people look for because many people mistakenly thought that by taking medical protection is sufficient to cover medical and hospitalisation expenses should anything untoward happens to them. Little did they know that the medical plan covers partially or may not cover certain hospitalisation expenses at all, depending on the plan they participate in. They will only realise it when they are hospitalised and received a bill with a shocking amount, which they thought the medical Takaful would cover. Don’t let this happen to you.

Medical Takaful typically does not cover a full medical and hospitalisation bill. It often comes with a cap, and you have to pay a portion of the bill such as deductible and co-Takaful. For instance, your medical bill is RM10,000 and deductible amount is RM3,000 with co-Takaful percentage of 10%. You will need to pay RM3,700 whilst the remaining of RM6,300 will be borne by Takaful. This is where a Medical rider comes in handy. It will cover the deductible and co-Takaful either partially or totally, so you would not have to fork out a large chunk out of your pocket to pay for the bills or you don’t have to pay at all. Look out for a good Medical Rider such as the one offered by Great Eastern Takaful with no co-Takaful feature, in excess of the deductible amount.

Furthermore, Healthcare Rider not only cover deductibles and co-Takaful. Some are designed for the Person Covered to add on other needs. For example, your Room & Board medical Takaful plan is RM200, but upon admission to the hospital, all rooms with that price are not available, which forced you to upgrade your room that costs RM300 per night. With Hospitalisation Rider, you will receive daily cash benefit which may compensate the difference you have to bear, just like the takaful trust that Great Eastern Takaful offers.

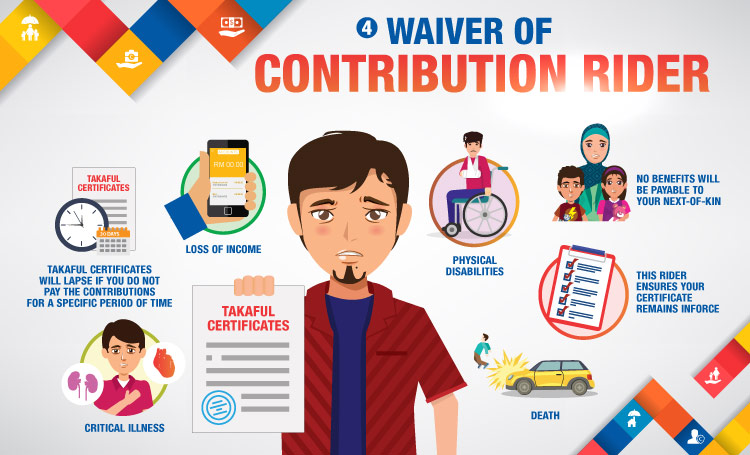

Waiver of contribution rider

This rider is an excellent rider to ensure your Certificate remains inforce, when you are incapacitated to pay the contributions. This non-payment of contributions may arise out of financial situations such as loss of income, death, critical illness or physical disabilities suffered by the contributor. Most Takaful Certificates will lapse if you do not pay the contributions for a specific period of time, which means no benefits will be payable to your next-of-kin at the time of your death because the coverage has stopped due to non-payment. Therefore, the Waiver of Contribution Rider ensures that your Certificate remains inforce by offering Certificate continuance as all the future contributions get waived off and Takaful Operators pay the contributions themselves, often times from the Tabarru’ Fund. Upon plan maturity, the benefit will be paid to the nominee.

There are also a lot of options for you to choose from, with coverage varies from plan to plan. Some riders offer waiver of contributions only upon death of the Person Covered, some upon critical illness diagnosed or the Person Covered struck by total & permanent disability or both. There is also a more comprehensive Waiver of Contribution Rider, which cover all of the unfortunate incidents that will leave you and your loved ones a peace of mind. You can customise your protection plan according to your needs and budget.

Most basic plans do not provide additional or customised coverage according to your individual needs, but riders can help personalise your coverage as you wish. The riders sure seem like a necessity if we consider eventualities like the ones mentioned above. It’s true that we cannot prevent such incidents from happening but we can very well plan for them as preparation.

Be sure that you read all the fine prints before you add a rider into your basic Takaful Trust protection plan. There are certain waiting period you need to observe especially the Healthcare and Critical Illness Rider before the coverage kicks in. Also, bear in mind that these riders come with a price, which means a long term commitment. While these riders can be very persuasive, many may not be absolutely necessary for you. It is best that you discuss with your Takaful Advisor to evaluate the benefits of riders and add the ones best suited for you and your family.

If you are considering on adding riders to your basic Takaful protection plan and want to protect yourself and your loved ones, visit the various riders we offer that suit you.