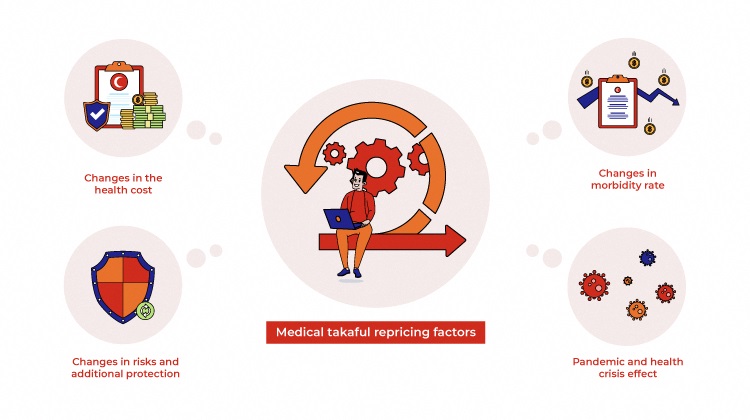

Medical takaful repricing factors

Stepping into the field of medical takaful needs a deep understanding about factors that affect the said repricing. In this article, we are going to explore the main elements that drive the repricing in medical takaful. It is important to understand these factors, for your health protection.

Stepping into the field of medical takaful needs a deep understanding about factors that affect the said repricing. In this article, we are going to explore the main elements that drive the repricing in medical takaful. It is important to understand these factors, for your health protection. Read on to understand the 4 main factors behind the medical takaful repricing that everyone should know of.

Changes in the health cost

One of the main reasons for medical takaful card repricing is the changes in the healthcare cost itself. Due to the economic inflation that has been around, the inflation gave a huge impact towards every aspect, including medical and healthcare costs. Other than the changes in medical costs, other costs such as healthcare services and the price for medical machines are also affected from this situation.

To avoid any circumstances in the imbalance between takaful providers and contributions that happen due to the changes of the healthcare cost, medical takaful repricing is done. This can cover the demands for Tabarru' for the next 20 to 30 years.

Changes in mortality cost

Did you know that mortality rates can also be a factor in the changing of the prices of medical takaful cards? Yes, mortality rate may interfere with the stability of the economical situation of medical takaful. The increase in mortality rates lead to the increment of medical claims, the overall cost of providing coverage costs arise accordingly. This increased claims experience can put pressure on the financial reserves of the takaful fund, potentially necessitating a repricing of contribution to ensure sustainability.

The higher the number of deaths, the higher the medical claims that will occur. A rise in mortality rates can also affect the cost of providing medical takaful coverage. If the number of claims increases due to higher mortality rates, the overall cost of providing coverage rises accordingly. This can lead to an imbalance between contributions collected and claims paid out, prompting the need for adjustments in contribution rates to align with the increased costs of coverage.

Changes in risk and additional protection

In relation to the mortality costs, takaful providers are pushed to stabilise the imbalance in the medical takaful cost. Mortality rate is a key factor in assessing the risk associated with providing medical takaful coverage. Takaful companies use actuarial analysis to estimate the likelihood of certificate holders passing away during the coverage period. If the mortality rate increases, it indicates a higher probability of claims being made, which can impact the financial stability of the takaful fund.

Takaful providers may need to adjust their underwriting practices in response to changes in mortality rates. This could involve tightening eligibility criteria for implementing stricter medical underwriting to mitigate the risks associated with facilitating individuals who may have a higher likelihood of mortality. These adjustments can influence the pricing of medical takaful products to reflect the perceived risk of covering certain demographics or additional protections to certain health conditions.

Pandemic and health crisis effect

The pandemic has given a huge impact towards our lives, especially when it comes to medicinal practices. Since the COVID-19 pandemic started a few years ago, the crisis of long-term health impacts has been prevalent and requires attention from takaful providers. Takaful providers may need to consider the potential for increased claims related to long-term COVID-19 effects when repricing medical takaful products. This could involve factoring in the likelihood of ongoing medical treatment and care for individuals affected by COVID-19 in the future.

The pandemic and health crisis has led to a surge in healthcare costs, driven by the need for medical treatment, hospitalisation and intensive care for patients. Repricing of medical takaful would be necessary to ensure the contributions adequately cover the anticipated claims costs associated with the health crisis situation

Ending the debate on the factors of medical takaful repricing, it is important to remind that the repricing effect can be experienced by everyone. With a deep understanding of the factors affecting the medical takaful repricing, you can make a wiser decision based on your health protection. May this article give you a useful vision and help you manage your health protection needs