Takaful repricing: The why and how it affects us

The thought of our escalating contributions can be worrying and even makes you wonder if you should surrender your takaful plan. Many certificate holders do not know that takaful contributions, especially medical takaful, may increase through time, if necessary. Find out the why of Takaful repricing and what it means.

What is Takaful repricing?

Perhaps you would have received a message like this:

Perhaps you would have received a message like this:

“INFO: There is revision in contribution for your Takaful plan. Download important documents from i-Get In Touch.”

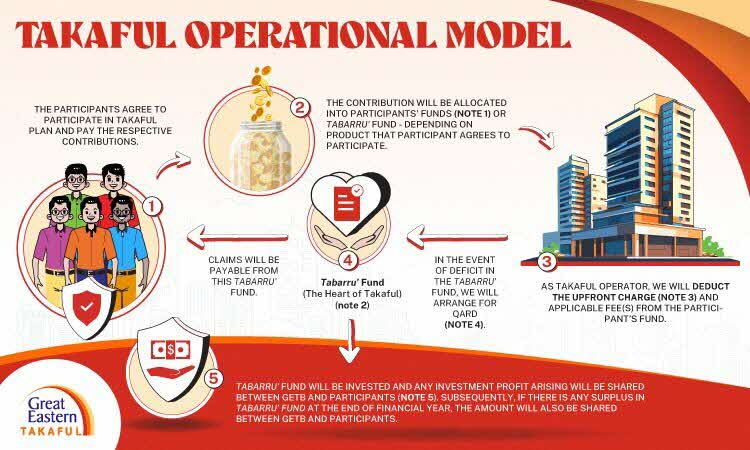

As illustrated in the above, Takaful plan repricing refers to a revision in contribution on a Takaful plan. The thought of our escalating contributions can be worrying and even makes you wonder if you should surrender your Takaful plan. But hold that thought! Many Takaful participants do not know that Takaful contributions, especially medical and health Takaful, may increase through time to cover for increase in Tabarru’ charges, if necessary.

Let’s dig into the why of Takaful plan repricing and what it could mean for us.

What is Takaful repricing?

Perhaps you would have received a message like this:

Perhaps you would have received a message like this:

“INFO: There is revision in contribution for your Takaful plan. Download important documents from i-Get In Touch.”

As illustrated in the above, Takaful plan repricing refers to a revision in contribution on a Takaful plan. The thought of our escalating contributions can be worrying and even makes you wonder if you should surrender your Takaful plan. But hold that thought! Many Takaful participants do not know that Takaful contributions, especially medical and health Takaful, may increase through time to cover for increase in Tabarru’ charges, if necessary.

Let’s dig into the why of Takaful plan repricing and what it could mean for us.

What triggers repricing?

For example, in 2023, Zaid had to undergo an emergency surgery for a bone dislocation removal for RM15,000. Not long after, he met a friend whose relative had undergone a similar surgery for RM8,500 back in 2019. Naturally, he questioned the price difference.

The rise of treatment costs would mean a rise in claims amount, and this is caused by medical inflation. Did you know that Malaysia’s current annual medical inflation rate peaks at 15% which is 384% higher than the general inflation rate? This is significantly higher than the global medical inflation rate average of 10.1%, or compared to the Asia-Pacific region’s average of 9.7%. This rising medical inflation impacts the cost of medical treatment to increase and over time, medical related claims also increase accordingly and leave significant impact to the Tabarru’ fund.

Medical Takaful plan are often times affected by repricing, but so are non-medical Takaful plans. Repricing for non-medical plans, though rare, may happen too.

The pandemic did not help either – the world’s economy was severely impacted, and we are going through tough times. Now that the economy has opened up, Malaysians have been hit with news of the rising cost of basic goods and fuel, resulting in a rise in prices at eateries, medical services and other industries.

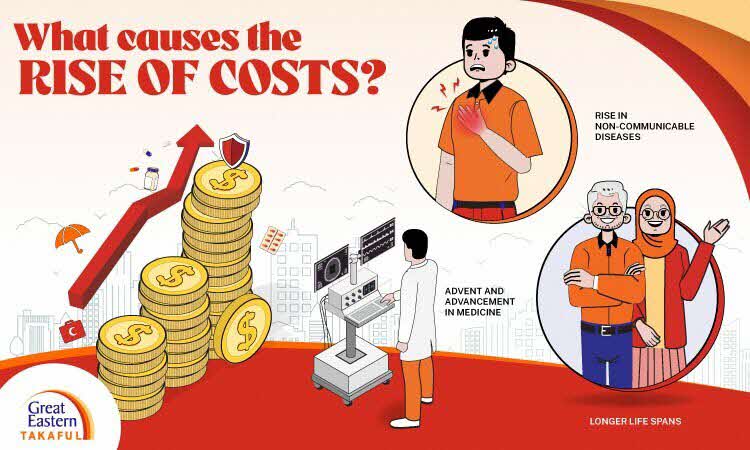

What causes the rise of costs?

These rising costs are also attributed to the rise in non-communicable diseases (NCDSs), longer life spans, mainly due to the advent and advancement in medicine.

Malaysian healthcare system is facing challenge in the rise of non-communicable diseases (NCDs) and the emergence of both new infectious diseases and resurging infectious diseases which includes, but not limited to cardiovascular diseases, chronic respiratory diseases, cancer and diabetes. The surge in NCDs has resulted in increasing treatment costs due to expensive long-term treatments, frequent consultations, and medications.

Older people are also learning to care for themselves, aspiring to keep youthful and healthy. With longer life spans, however, come treatments of medical conditions for a longer term. The demographic shift towards an older population increases the demand for healthcare services, which causes the upward trend in healthcare costs. The irony of the longer life spans is that though there are people looking out for their health, many also have adopted unhealthy, inactive lifestyles as a whole. These could result in illnesses, physical and mental, if not mindful.

As medical institutions take on the newest equipment and technology, big investments need to be made for implementation. Technological advancements in the medical field have revolutionised the way healthcare is delivered, offering new possibilities for diagnosis, treatments, and patient care. These innovations come with high development and implementation cost. Not forgetting - having to hire qualified staff to operate such equipment and training those who are less experienced. The Great Resignation has narrowed the talent pool in many industries, causing the higher cost in hiring talent.

Specific to non-medical Takaful, there are rare occurrences when repricing will take place. An instance would be if the claims experience for a particular product is poor. When claims experience is found to be bad, whereby there are more claims than expected, Takaful operators would need to reprice to ensure the sufficiency of the Tabarru’ fund for future claims, on the basis of helping each other in times of need

What does it affect us and what can we do?

While Takaful contributions are bound to rise, meaning having to pay a little extra and potentially affect your finances, Takaful coverage is still a must-have. As consumers, we should be informed and wise!

First, be sure to revisit your existing Takaful coverage and make adjustments where necessary. It helps to have a customisable plan so that you can cater to what you and your family really need. This would help you to get just enough coverage, without over-protecting yourself.

Furthermore, it helps to compare the expected costs between hospitals and treatments, though make sure they are of reputable quality! If you are discharged from a hospital, make a request for an itemised bill to verify and inspect for any possible unreasonable charges. This aids in advocating for transparency from medical institutions to customers.

Looking ahead

Takaful contributions will increase in the years to come, but you can have peace of mind that you and your family will be cared for.

Great Eastern Takaful Berhad on the other hand, strives to care for customers’ needs.

With the availability of information on the Internet, consumers these days are also growing just as if not more informed, and are bold to speak out on injustices. As mentioned previously, practice reviewing your existing Takaful plan(s). So play your role, and rest assured, we got you!

Check out our various plans and choose one (or maybe two) that best suit you.