What does it take to waste RM3,600 a year? Only RM10 a day spent on miscellaneous. What could be the RM10 you spend unnecessarily a day? It could be a pack of cigarette, list of snacks from chips, ice-cream, chocolates and cookies; lifestyle drinks of boba teas alike and a lot more items you don’t necessarily need to spend.

According to a statistic conducted by Ministry of Finance, Malaysians spend 31.2% of their salary on food, which is about RM20 to RM50 a day. Do you know with that RM10 a day you spend on miscellaneous, you could protect yourself against life uncertainties such as death, disability, accident, illness and on top of that earn potential return from investment fund? Let’s find out how.

There are many ways you could waste RM3,600 a year, or precisely RM10 a day. But why spend unnecessarily for items you don’t even need when you can get yourself protected should anything untoward happens to you? At the same time, you get to invest at your own preference and enjoy the potential returns later on. With RM10 a day, you will be able to get death and total & permanent disability benefit of up to RM300,000 and up to RM100,000 for critical illness, RM90,000 for medical and accidental benefit for RM40,000.

Apart from that, you can opt for additional services such as Badal Hajj and Waqf in the event of your passing. You may also perform Hibah for your loved ones or chosen charity for continued legacy. What’s more, you are also entitled for tax relief. All of this for such a small amount of money. Don’t let it go to waste! Sounds good?

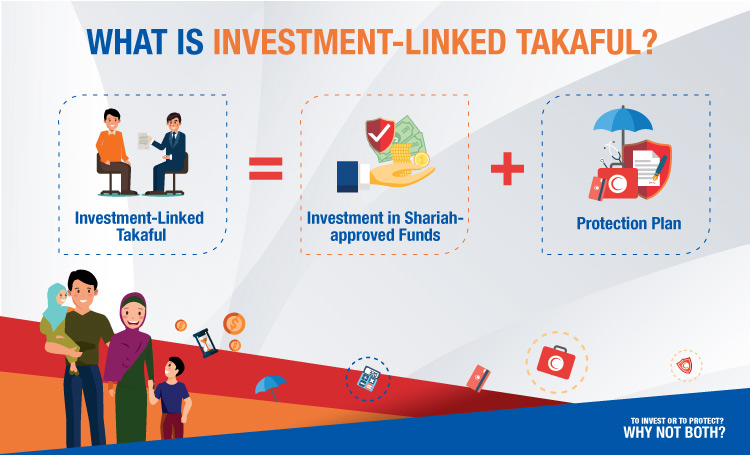

Click here to find out more about Investment-Linked Takaful Plan.