As one of Asia’s visionaries in the takaful industry, we care for your needs and safeguard your future.

Have you noticed? The older we get, the more we hear the word “legacy” from around us. Growing up, many of us may think that “leaving a legacy” means leaving a lasting impact on those around us even after we have passed, much like the words of the environmentalist David Brower who said:

“We must begin thinking like a river if we are to leave a legacy of beauty and life for future generations.”

He mentioned that in light of wanting to ensure the beauty of nature is preserved for generations to come. While that makes reference to one type of legacy, there is another aspect of legacy that we may hear more of in our later years – the financial kind. Let’s look into what a legacy is and what leaving one looks like!

One of the first steps in self-improvement is to ensure you have some goal in place. Start by identifying what you want to achieve and break it down into smaller, achievable targets. Whether it is improving your fitness, advancing in your career, enhancing your relationships or other areas of self-improvement, having clear goals provides direction as well as motivation. Write them down and create an action plan to track your progress. Celebrate milestones along the way to keep yourself motivated.

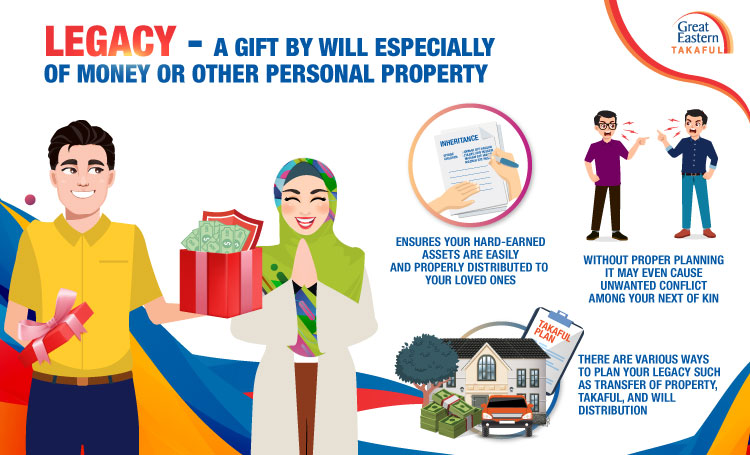

Leaving a legacy is important because it ensures your hard-earned assets are easily and properly distributed to your loved ones, especially once you have passed on. Imagine the trouble that we may subject our loved ones to, from not planning accordingly. It may even cause unwanted conflict among your next of kin.

To avoid all the hassle, here are some ways to leave a legacy, or an inheritance.

There are plenty of ways of which you can leave a legacy for your loved ones – via transfer of property, Takaful, and will distribution.

Property, like a house, building, apartment unit or land, is one of the ways you can leave a legacy, as it is an asset that holds much value – both emotionally and economically. Often, people would transfer the ownership of their homes to their children through a will or wasiat, which we will explore soon. Based on the type and accessibility of property, values of Malaysian properties on average can range from RM220,000 to RM740,000. Depending on the economic conditions, the value of these properties may grow exponentially too.

So whether you own property or not, take this as a note to ensure that your children will one day be able to inherit its wonderful value!

Another way is by participating in a Takaful plan, as a means to ensure your family’s livelihood is sustained for a while through hibah or gift, in the event of your passing. If you as a Takaful participant have passed away, the nominee appointed by you will receive absolute compensation for the benefits of the plan.

You can also opt to transfer the ownership of your Takaful plan to your children for education and/ or protection purposes. It will be even more beneficial if it had an investment element to grow its value.

Being covered by Takaful definitely has its advantages, to protect your life and the life of your family should something unfortunate happen.

Will distribution essentially refers to the distribution of your wealth or legacy. There are two laws that concern it, which determine how your wealth is passed on.

They are the Shariah law, which solely applies to Muslims, and the civil law. Did you know? The civil law allows for you to determine the distribution upon your death through a will to any loved one. On the other hand, the Shariah law bases inheritance on faraid principles which determines the shares, limits, and path of inheritance, whereby only up to one-third of the total wealth can be determined through a wasiat. Through a will or wasiat, you can also choose to leave your legacy by donating to a cause close to your heart.

The older you get, the more important it is to prepare a will or wasiat to determine where your wealth goes upon your death, and to prevent potential conflicts from arising.

Suffice to say, leaving a legacy is a wonderful way to still extend your family love in your passing. Regardless through property transfer, Takaful benefits, or will distribution, the pros of leaving an inheritance far outweigh its cons. While most of these make reference to a financial legacy, there is no doubt it can leave a lasting impact and impression on your loved ones.

As one of Asia’s visionaries in the takaful industry, we care for your needs and safeguard your future.

Great Eastern Takaful is a name you can trust for all your takaful solutions.

Great Eastern Takaful’s visionary leaders have steered the company from strength to strength.